COMEX Gold - Tagging The Rebound

rhboskres

Publish date: Tue, 01 Sep 2020, 11:47 AM

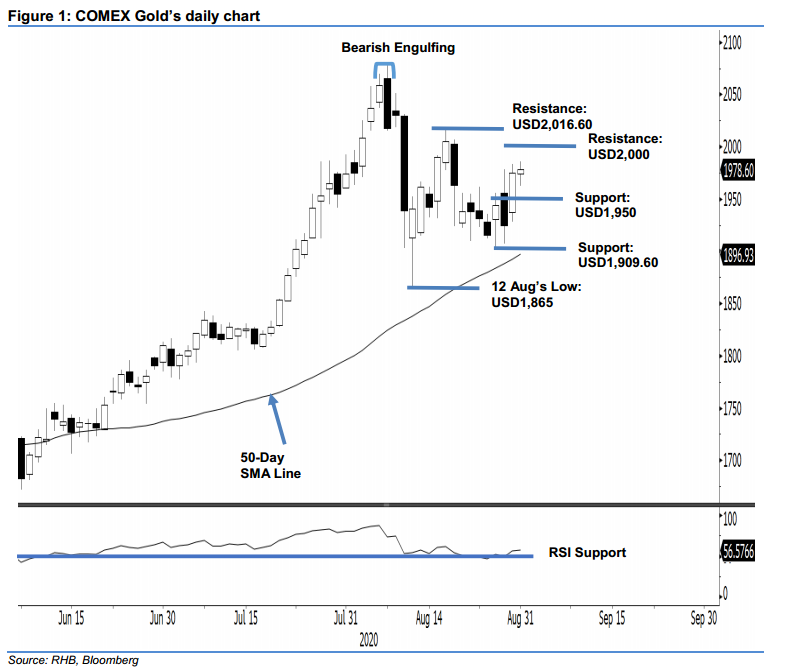

Initiate long positions to tag the rebound. The COMEX Gold ceased the latest session USD3.70 higher at USD1,978.60. As highlighted in our 25 Aug report, the precious metal has been showing signs of extending its rebound, following the sharp retracement seen between 7 Aug’s high of USD2,078, and 12 Aug’s low of USD1,865. This thesis is supported by the recent sessions’ relatively strong rebound off the low of 26 Aug’s USD1,901.40. We switch our trading bias from negative to positive.

Our previous short positions initiated at USD1,938.90, which was the closing level of 10 Aug, were closed out on 26 Aug at the breakeven point. Concurrently, we initiated long positions at the closing level of USD1,944.10. For risk-management purposes, a stop-loss can be placed below the USD1,925 mark.

The immediate support is revised to USD1,950, followed by USD1,909.60 – the low of 21 Aug. Moving up, resistance points are pegged at the USD2,000 round figure, followed by USD2,016.60, or the high of 18 Aug

Source: RHB Securities Research - 1 Sept 2020

.png)

.png)