Hang Seng Index Futures - Testing the 20-Day SMA Line

rhboskres

Publish date: Thu, 04 Mar 2021, 06:43 PM

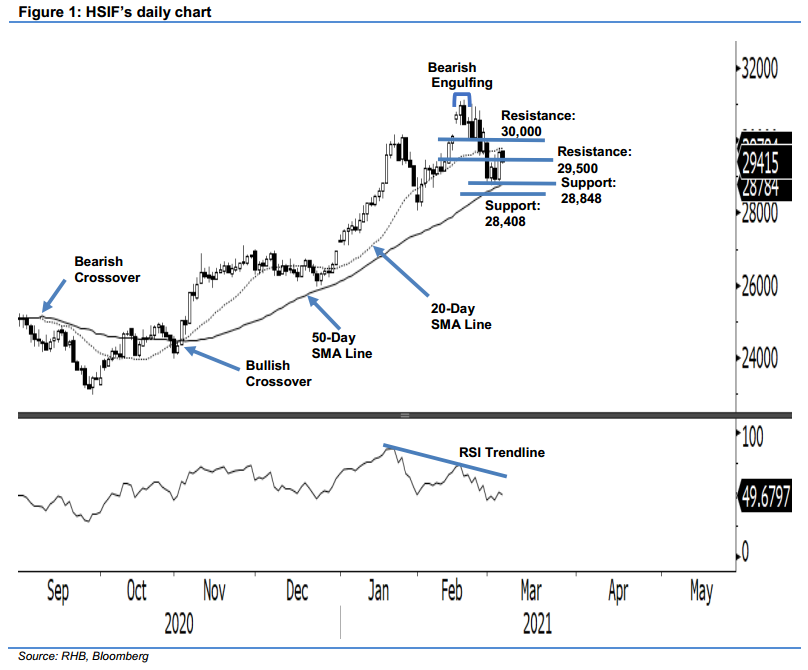

Maintain short positions. The HSIF saw the emergence of bullish momentum in the afternoon, adding 755 pts from Tuesday’s 28,929 pts, to settle at 29,684 pts. Yesterday, it opened slightly higher at 29,093 pts. After briefly touching a low of 29,005 pts, the tide changed, with the index climbing to a high of 29,795 pts. However, mild profit-taking was seen in the evening session, with the index closing lower at 29,415 pts. Based on the latest price action, the bulls are not giving up yet, and are attempting to stage a rebound above the 20-day SMA line. If the index manages to cross above 29,700 pts, it will be an early indication that the uptrend will resume. Otherwise, it will continue to consolidate between the 20- and 50-day SMA lines. As we have yet to see a fresh “higher high”, we believe the index remains in a correction phase. We keep our negative trading bias.

We recommend traders maintain the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management purposes, the trailing-stop is set at 29,700 pts.

The immediate support is maintained at 28,848 pts, followed by 28,408 pts. Towards the upside, the immediate resistance is seen at the 29,500-pt round figure, and followed by the 30,000-pt psychological level.

Source: RHB Securities Research - 4 Mar 2021

.png)

.png)