WTI Crude - Climbing Above the USD75.00 Resistance Level

rhboskres

Publish date: Wed, 14 Jul 2021, 05:50 PM

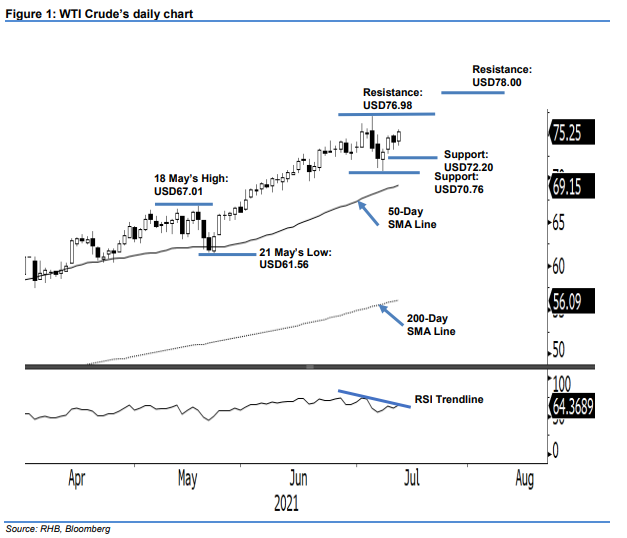

Maintain short positions. After dipping mildly on Monday, the WTI Crude bounced off yesterday, climbing USD1.15 to close at USD75.25 – nearing the USD75.35 stop-loss level. The commodity opened at USD74.18 yesterday before falling to the USD73.68 session low. During the US trading session, strong buying interest emerged – this allowed it to pare the intraday losses and move higher to close at USD75.25. From the latest price movement, where a bullish continuation pattern was seen, we can see the bulls regaining control. This is as the WTI Crude moved away from its recent sideways consolidation phase, which was capped at USD75.00. However, as the commodity has not breached the USD75.35 stop-loss level, we stick to our short positions. Until it breaches the stop-loss threshold, we stick with our negative trading bias.

Traders are advised to stick with the short positions initiated at USD72.20, or the closing level of 7 Jul. To manage the trading risks, an initial stop-loss threshold is placed at USD75.35.

The immediate support level is fixed at USD72.20 – 7 Jul’s close – and followed by USD70.76, or the low of 8 Jul. Meanwhile, the immediate resistance is pegged at USD76.98, ie the high of 6 Jul, and followed by the USD78.00 whole number.

Source: RHB Securities Research - 14 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024