WTI Crude - Shifting Back to a Bearish Momentum

rhboskres

Publish date: Thu, 15 Jul 2021, 09:49 AM

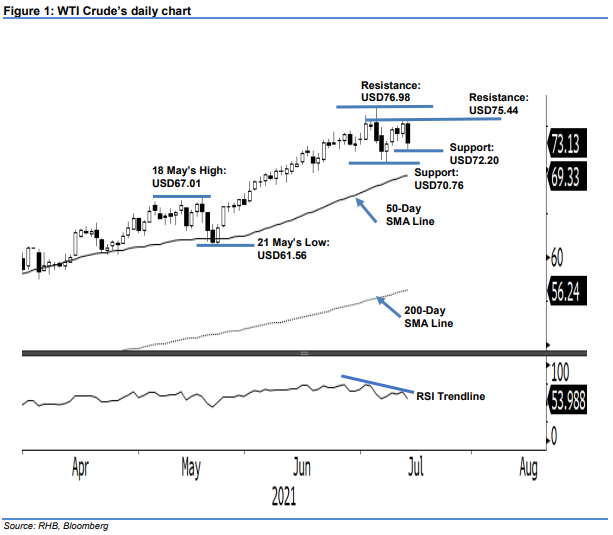

Maintain short positions. The WTI Crude offset its recent gains yesterday as it tumbled USD2.12 to close at USD73.13 – back to below the USD75.00 level. The commodity began the session at USD75.17 and merely tapped the USD75.44 day high before selling interest emerged, which saw it falling firmly throughout the session. The black gold then hit the USD72.21 session low to close at USD73.13. The latest price action signals that the bears remain in control, erasing the bullish momentum. As the WTI Crude shied away from the USD75.00 level, the bearish momentum may be strengthened in the coming sessions. Unless the commodity breaches the stop-loss threshold, we are keeping to our negative trading bias.

We recommend traders maintain the short positions initiated at USD72.20, or the closing level of 7 Jul. To manage trading risks, an initial stop-loss threshold is set at USD75.35.

The immediate support level remains at USD72.20 – 7 Jul’s close – and followed by USD70.76, or the low of 8 Jul. Conversely, the immediate resistance is changed to USD75.44, ie the high of 14 Jul, and followed by the USD76.98 – the high of 6 Jul.

Source: RHB Securities Research - 15 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024