COMEX Gold - The Bullish Momentum Extends

rhboskres

Publish date: Thu, 15 Jul 2021, 09:50 AM

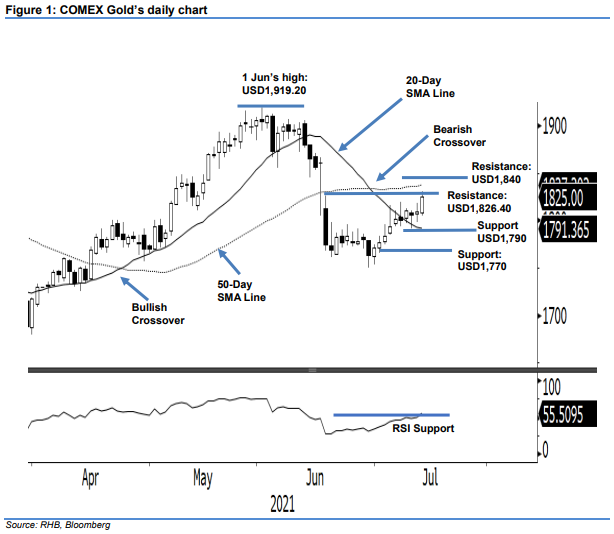

Maintain long positions. The COMEX Gold displayed a strong bullish momentum yesterday after soaring USD15.10 to close at USD1,825. It opened the session slightly weaker at USD1,808.30 and tapped the intraday low at USD1,804.90. It then bounced off strongly northwards to hit the intraday high at USD1,831.10 before settling at USD1,825. The strong bullish candle (a long white candle) that formed yesterday was in line with our earlier expectation, where the strong interim base near the 20-day SMA line was formed – this solidifies the bullish momentum ahead. Supported by the RSI, which is curving upwards above the 50% level, the odds are high for the COMEX Gold to breach above the immediate resistance and subsequently test the 50-day SMA line. Unless the momentum falters – falling below the 20-day SMA line – we stick to our positive trading bias.

We recommend traders hold the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To mitigate the downside risks, the stop-loss threshold is set at USD1,784.70.

The downside support is marked at USD1,790 and then the USD1,770 round figure. Meanwhile, the upside resistance is set at USD1,826.40 – 17 Jun’s high – and followed by the USD1,840 whole number.

Source: RHB Securities Research - 15 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024