FKLI - Looking Towards Retesting The Support Level

rhboskres

Publish date: Thu, 15 Jul 2021, 09:50 AM

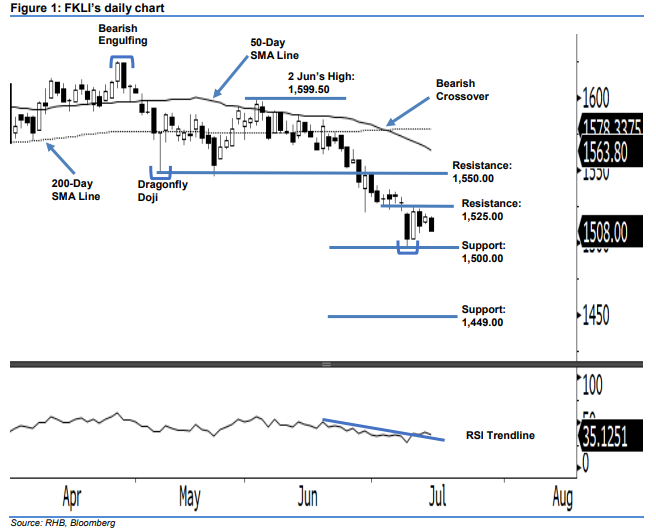

Maintain short positions. Despite undergoing a mild rebound on Tuesday, the FKLI erased gains and shed 10 pts to close at 1,508 pts yesterday. It opened at 1,517 pts, tapped the intraday high of 1,518 pts then slipping to the day’s low of 1,508.0 pts before closing. As the index failed to push above 1,525 pts and trended south to form a bearish candlestick, it is likely to extend the downward movement to retest 1,500-pt major support level. Unless the index reverses direction and forms a fresh “higher high”, we stick to a bearish trading bias.

Traders should maintain short positions. We initiated these at 1,569.50 pts, or 11 Jun’s closing. To mitigate trading risks, we revise the trailing-stop to 1,525.00 pts.

The next two support levels are at 1,500 pts then 1,449 pts – the lowest level recorded in Nov 2020. Meanwhile, the immediate resistance level is pegged at 1,525.00 pts or 9 Jul’s high, followed by 1,550.00 pts (26 Feb’s low).

Source: RHB Securities Research - 15 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024