WTI Crude - The Bearish Momentum Continues

rhboskres

Publish date: Fri, 16 Jul 2021, 05:24 PM

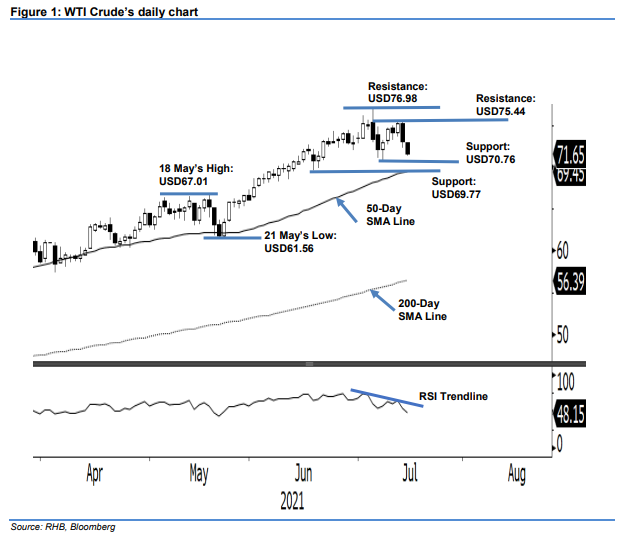

Maintain short positions. The WTI Crude saw another bearish session yesterday, falling USD1.48 to settle at USD71.65. It began Thursday at USD72.96 before progressing lower throughout the session. Despite the bulls staging a brief rally to reach USD72.73 during the US session, it was not strong enough to retest the opening price or the day high. Subsequently, it surrendered the intraday gains to reach the USD71.40 day low just before the close – charting a long black body candlestick. From the latest price action, every intraday rebound met heavy selling pressure, which indicates that sentiment remains weak. It is likely that the negative momentum will drag the commodity to retest the USD70.76 immediate support soon. Hence, we stick to our negative trading bias.

Traders are advised to maintain the short positions initiated at USD72.20, or the closing level of 7 Jul. To reduce trading risks, an initial stop-loss threshold is placed at USD75.35.

The immediate support level is revised to USD70.76 – the low of 8 Jul – and followed by USD69.77, or 17 Jun’s low. Meanwhile, the immediate resistance remains at USD75.44, ie the high of 14 Jul, and followed by USD76.98 – the high of 6 Jul.

Source: RHB Securities Research - 16 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024