COMEX Gold - Strong Profit-Taking Begins

rhboskres

Publish date: Mon, 19 Jul 2021, 09:29 AM

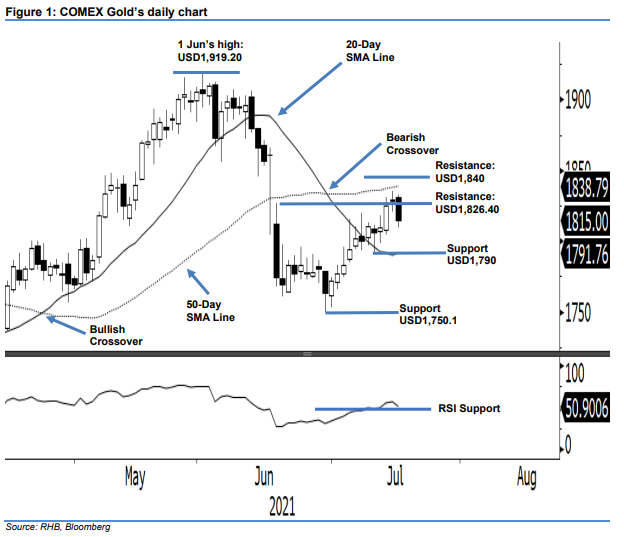

Maintain long positions. The COMEX Gold reversed its momentum into negative territory last Friday after taking profit by USD14.00 – it ended the week at USD1,815. It started the session with a neutral tone at USD1,830.70 and tapped the day high at USD1,832.70 before moving gradually lower throughout the session. The commodity hit the day’s low at USD1,809.50 before closing at USD1,815. The long black candlestick, which formed last Friday, signalled that profit-taking activities may have the strength to continue further towards the nearest support level at USD1,790 in the coming sessions. With the RSI curving downwards to near the 50% mark, this showed the bullish momentum has faded away – the bearish momentum will be more evident if it falls below the 50% level in the coming sessions. Until it breaches below the stop-loss level, we retain our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To mitigate the downside risks, the stop-loss threshold is pegged at USD1,790.

The support levels are revised lower to USD1,790 and the USD1,750.1, or 29 Jun’s low. Meanwhile, the immediate resistance is placed at USD1,826.40 – 17 Jun’s high – and followed by the USD1,840 whole number.

Source: RHB Securities Research - 19 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024