WTI Crude - Testing the USD70.00 Psychological Level

rhboskres

Publish date: Mon, 19 Jul 2021, 09:30 AM

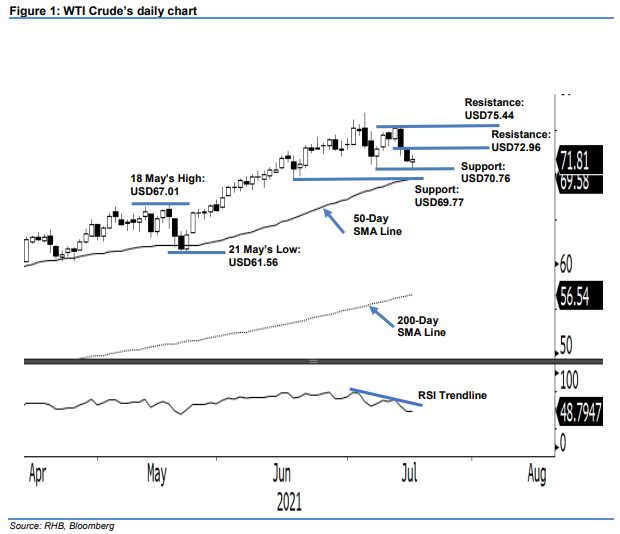

Maintain short positions. Despite the selling pressure seen last Friday, the WTI Crude managed to stage a mild rebound, rising a marginal USD0.16 to close at USD71.81. The commodity initially opened at USD71.48 and rose to test the intraday high at USD72.30. During the US session, it fell to the USD70.41 session low before paring intraday losses to close at USD71.81 where it printed a long lower shadow. Although mild buying pressure is seen near the support level, the WTI Crude has been in correction mode for the past four sessions, forming a “lower low” bearish pattern. If it breaches the USD69.77 support level – trading below the 50-day SMA line – we will then see a deeper correction. Since the commodity is showing signs of weakness, we maintain our negative trading bias.

Traders should stick to the short positions initiated at USD72.20, or the closing level of 7 Jul. For trading risk management, an initial stop-loss threshold is set at USD75.35.

The nearest support level is marked at USD70.76 – the low of 8 Jul – and followed by USD69.77, or 17 Jun’s low. Meanwhile, the immediate resistance seen at USD72.96 – the high of 15 Jul – and followed by USD75.44, ie the high of 14 Jul.

Source: RHB Securities Research - 19 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024