WTI Crude - Breaching Below the 50-day SMA Line

rhboskres

Publish date: Wed, 21 Jul 2021, 05:11 PM

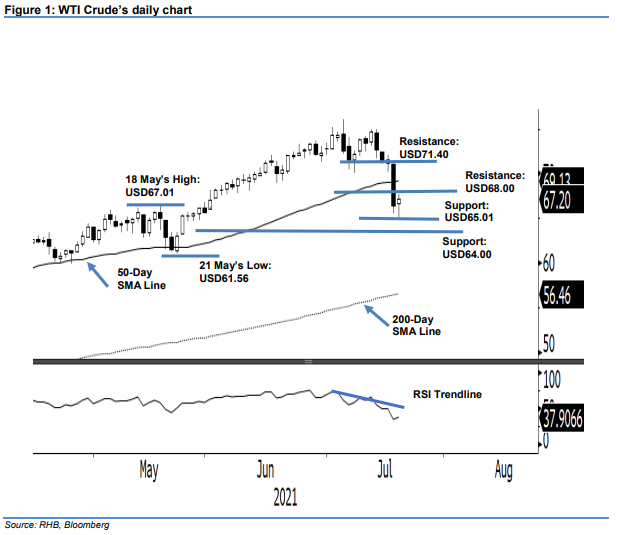

Maintain short positions. On Monday’s session, the WTI Crude September futures contract fell sharply, breaking below the 50-day SMA line. During Tuesday’s session, it managed to stage a mild rebound, rising USD0.85 to close at USD67.20. The commodity initially experienced stong selling pressure after it started Tuesday’s session at USD66.61. It fell to the USD65.01 day low before paring the intraday losses to close higher at USD67.20 – printing a long lower shadow pattern. With the latest buying pressure witnessed near the USD65.01 support level, the selling pressure is subsiding, giving opportunity for the bulls to consolidate sideways. If the bulls fail to reclaim the USD68.00 level post consolidation, it may drift lower again to seek stronger support. Since the WTI Crude is trading below the 50-day SMA line, the correction phase has started – we retain our negative trading bias.

We recommend traders maintain the short positions initiated at USD72.20, or the closing level of 7 Jul. For trading risk management, the trailing-stop mark is set at the USD70.00 psychological level.

The nearest support level is revised to USD65.01 – 20 Jul’s low – and followed by the USD64.00 whole number. Conversely, the immediate resistance is pegged at USD68.00, followed by USD71.40, ie the high of 19 Jul.

Source: RHB Securities Research - 21 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024