COMEX Gold - Testing the USD1,800 Psychological Level

rhboskres

Publish date: Wed, 21 Jul 2021, 05:11 PM

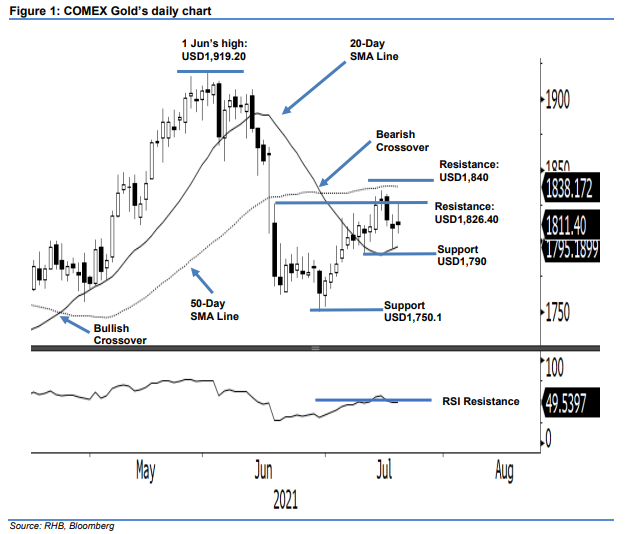

Maintain long positions. The COMEX Gold has seen profit taking taking place and is struggling to stay above the USD1,800 psychological level – it marginally rose USD2.20 yesterday and settled at USD1,811.40. The commodity began Tuesday at USD1,813.50 and stayed sideways for most of the session. Despite jumping during the US session to test the USD1,825.90 intraday high, it failed to hold on to the bullish momentum and faded – reaching the USD1,805.20 session low before its close. While the COMEX Gold is consolidating sideways, the bulls are attempting to build a consolidation zone just above the 20-day SMA line. In the event it falls below the 20-day SMA line, sentiment may turned bearish. As long as the COMEX Gold continues to trade above USD1,790 and forms a “higher low” pattern, the upward movement is deemed intact. For now, we retain our positive trading bias.

Traders should stay with the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To mitigate the trading risks, the stop-loss threshold is placed at USD1,790.

The support levels are marked at USD1,790 and the USD1,750.1, ie 29 Jun’s low. Meanwhile, the immediate resistance is sighted at USD1,826.40 – 17 Jun’s high – and followed by the USD1,840 whole number.

Source: RHB Securities Research - 21 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024