FKLI - Consolidating Sideways

rhboskres

Publish date: Thu, 22 Jul 2021, 05:34 PM

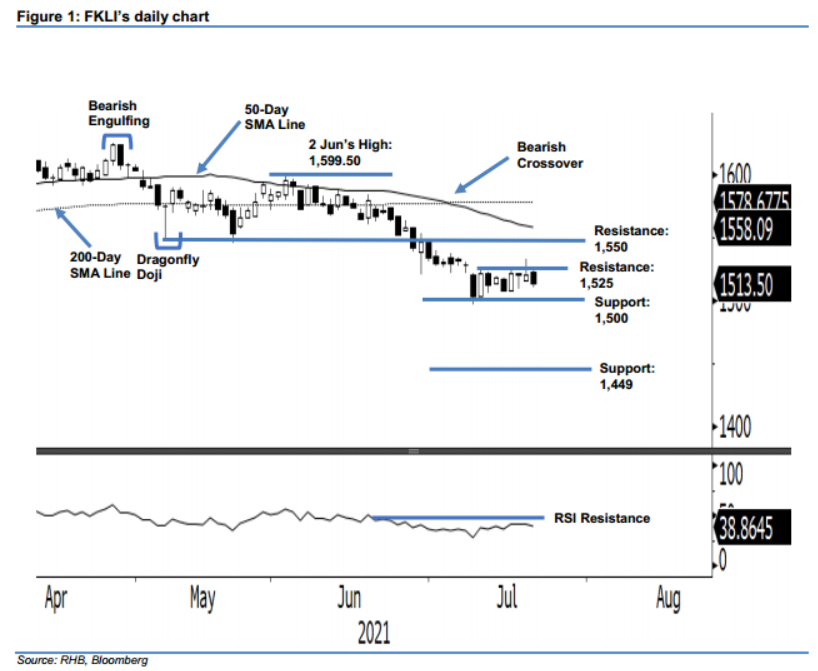

Maintain short positions. The FKLI continued to experience selling pressure during Wednesday’s session, falling 6.50 pts to settle at 1,513.50 pts – still closing below the immediate resistance of 1,525 pts. The index initially opened at 1,522.50 pts and rose to test the intraday high at 1,526 pts. However, selling pressure persisted at the resistance level, which saw the index fall to the day’s low at 1,510 pts before its closing, forming a black candlestick. The bears clearly dominated the session, with sentiment remaining weak. As long as the RSI continues to trend below the 50% threshold, any attempt of rebound will be met with strong selling pressure. Before the index crosses above the resistance level, it is likely to stay sideways. As such, we stand by our negative trading bias.

Traders should hold onto their short positions. We initiated these at 1,569.50 pts, or 11 Jun’s close. To control trading risks, we set the trailing-stop threshold at 1,525 pts, ie the immediate resistance.

The immediate support level is established at 1,500 pts, and then 1,449 pts, or Nov 2020’s lowest level. Meanwhile, the immediate resistance level is pegged at 1,525 pts – 9 Jul’s high – followed by 1,550 pts, ie the low of 26 Feb.

Source: RHB Securities Research - 22 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024