FCPO - Mild Profit Taking

rhboskres

Publish date: Thu, 22 Jul 2021, 05:36 PM

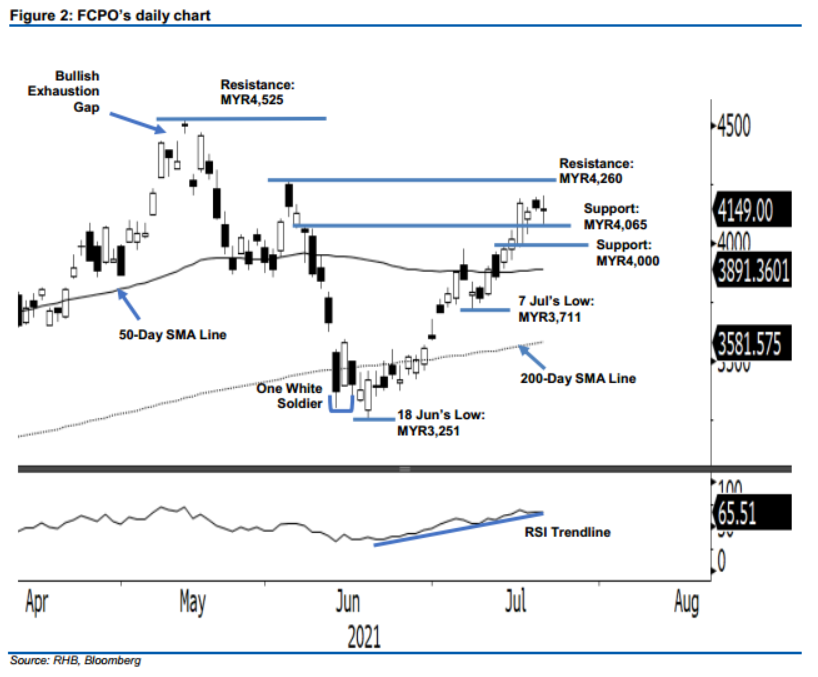

Maintain long positions. The FCPO continued to witness selling pressure near the resistance level as it marginally fell MYR2 to settle at MYR4,149. The commodity initially started Wednesday’s session at MYR4,138. After the opening, it jumped to test the intraday high of MYR4,200. However, the bulls failed to retain the momentum, which saw the commodity retrace to the day’s low of MYR4,078 before rebounding to close at MYR4,149. Although the FCPO has yet to take out the resistance formed at MYR4,260, it reacted positively to the support level at MYR4,065. As long as it continues to form a “higher low” pattern, the bullish structure remains intact. Falling below the immediate support level may see a correction towards the MYR4,000 level. At this juncture, we stick to our positive trading bias.

We recommend traders stick to long positions, which were initiated at the close of 13 Jul, or MYR3,977. For risk management purposes, the trailing-stop is fixed at MYR4,039.

The support levels are marked at MYR4,065 – the high of 8 Jun – and MYR4,000, ie the psychological level. Towards the upside, the immediate resistance level is pegged at MYR4,260 – 3 Jun’s high – and, subsequently, at MYR4,525, or 12 May’s high.

Source: RHB Securities Research - 22 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024