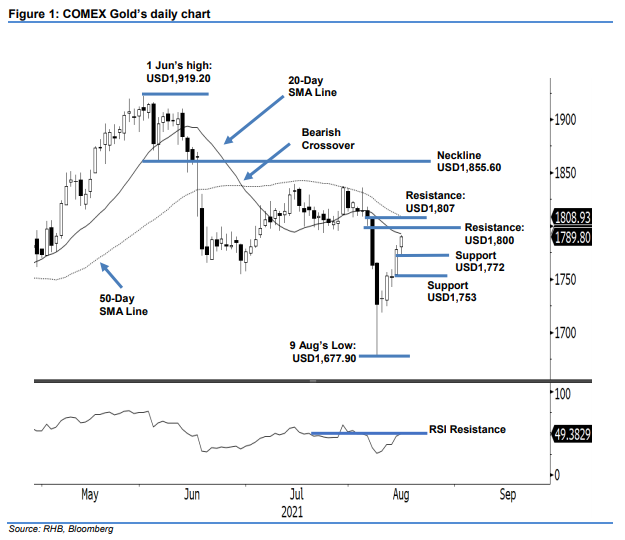

COMEX Gold - Bullish Momentum Extends to Test the 20-Day SMA Line

rhboskres

Publish date: Tue, 17 Aug 2021, 09:58 AM

Maintain long positions. The COMEX Gold extended its upward movement yesterday, rising USD11.60 to close at USD1,789.80. The commodity started Monday’s session at USD1,780.90 and dipped to the USD1,772 session low for consolidations. Strong buying momentum emerged during the US trding hours where it jumped to test the intraday high at USD1,791.30 and stayed sideways until the close. With the latest positive closing, the E-Mini Dow managed to recoup most of the losses since the USD1,677.90 low was established on 9 Aug with a long lower shadow. If the RSI crosses the 50% threshold in the coming sessions, the current momentum will be strengthened and thrust the commodity higher. Meanwhile, we expect mild selling pressure to rise near the 20- day SMA line. As the rebound from USD1,677.90 still intact, we stick to our positive trading bias.

We recommend traders shift over to the long positions we initiated at USD1,778.20, or the closing level of 13 Aug. To limit the downside risks, an initial stop-loss threshold is set at USD1,742.60.

The immediate support is revised to USD1,772 – 16 Aug’s low – followed by USD1,753, ie the low of 13 Aug. The immediate resistance is pegged at the USD1,800 psychological level, followed by USD1,807, or 6 Aug’s high.

Source: RHB Securities Research - 17 Aug 2021