WTI Crude - Bears Attempt to Breach the Support

rhboskres

Publish date: Tue, 17 Aug 2021, 09:58 AM

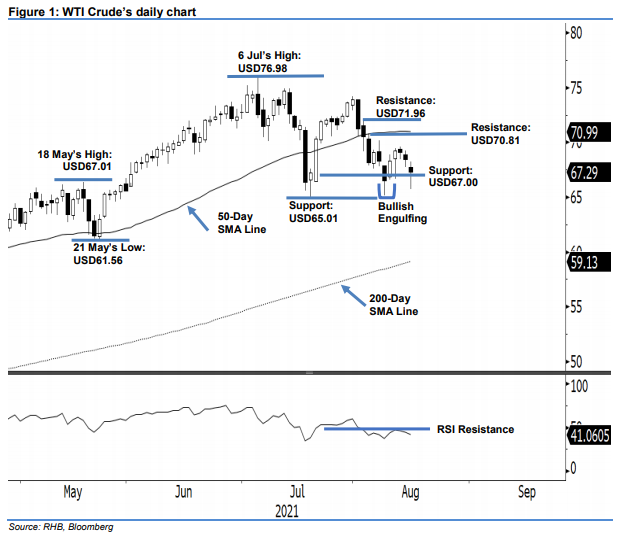

Maintain short positions. The WTI Crude’s bears took profit for a third consecutive day yesterday, as it dropped USD1.15 to settle at USD67.29. Despite opening weaker at USD67.71, the commodity managed to tap its day high of USD68.27. The black gold then reversed momentum in a whipsaw fashion, which saw it mark the lowest point of USD65.73 at the start of the US trading hours. Strong buying pressure then saw the WTI Crude bounce off before the close. The black body candlestick with long lower shadow suggest that strong buying pressure may avert from breaching the immediate support in the immediate term. However, the recent “lower highs” pattern that formed below the 50-day SMA line, coupled with the weak RSI below the 50% level, warrants the bears continuing to take the lead in the medium term. As such, we maintain our negative trading bias.

We recommend traders stick to the short positions initiated at USD70.50, or 3 Aug’s closing level. For riskmanagement purposes, the stop-loss level is set at USD70.81, ie 4 Aug’s high.

The support levels are fixed at USD67.00 and USD65.01, or 20 Jul’s low. The immediate resistance level is maintained at USD70.81, which was 4 Aug’s high, and then followed by USD71.96, ie 3 Aug’s high.

Source: RHB Securities Research - 17 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024