WTI Crude - Negative Momentum Breaches the Immediate Support

rhboskres

Publish date: Wed, 18 Aug 2021, 05:41 PM

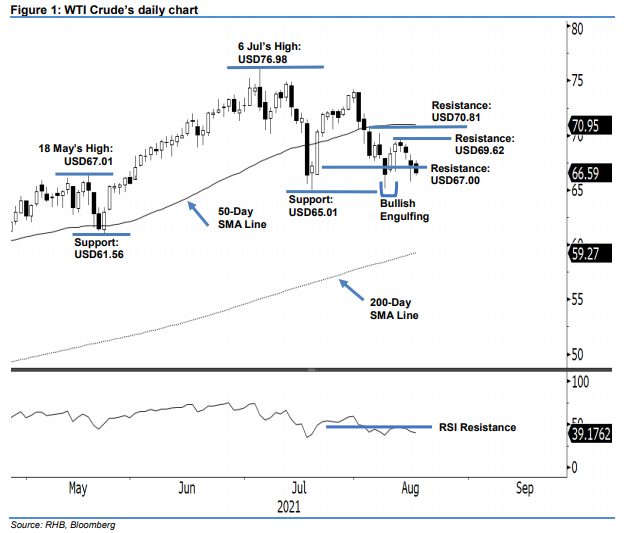

Maintain short positions. After falling for three consecutive sessions, the WTI Crude continued its negative momentum by breaching the immediate support as it fell USD0.70 to close at USD66.59. Despite opening slightly higher at USD67.43 and inching up mildly, the commodity changed direction southwards in a whipsaw fashion – staging a mini rebound to tap the day’s peak of USD67.72 at the start of the US trading hours. This was shortlived, however, as the bears took the lead towards the day’s bottom at USD66.33 before the close. The black body candlestick that breached below the immediate support signals that selling pressure will get more intense below the USD67.00 level in the coming sessions, This is amidst the recent “lower highs” pattern that formed below the 50- day SMA line, coupled with the weaker RSI below the 40% level. As such, we stick to our bearish trading bias.

We recommend traders maintain the short positions initiated at USD70.50, or 3 Aug’s closing level. For riskmanagement purposes, the stop-loss level is pegged at USD69.62, ie 12 Aug’s high.

The immediate support level is set at USD65.01 – 20 Jul’s low – and followed by USD61.56, or 21 May’s low. The resistance levels are marked at USD69.62 – 12 Aug’s high – and USD70.81, which was 4 Aug’s high.

Source: RHB Securities Research - 18 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024