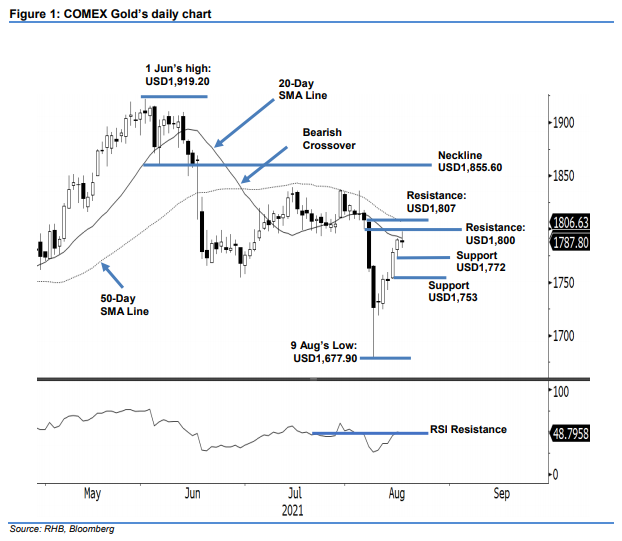

COMEX Gold - Consolidating Beneath the 20-Day SMA Line

rhboskres

Publish date: Wed, 18 Aug 2021, 05:41 PM

Maintain long positions. The COMEX Gold’s upward movement took a breather at the 20-day SMA line yesterday, declining USD2.00 to close at USD1,787.80. The commodity started at USD1,789.10 on Tuesday. It then oscillated between USD1,797.60 and USD1,782.10 before the close – forming a Doji pattern. The neutral candlestick formation showed both bulls and bears were at equal strength. Although it was able to print a fresh “higher high” pattern, the RSI is still below the 50% threshold, suggesting the COMEX Gold may need more consolidations before attempting to cross above the moving average again. If a retracement takes place, USD1,772 will act as immediate support. At this juncture, a bearish reversal pattern has not formed yet – hence we keep to our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate the downside risks, the stop-loss mark is revised higher to USD1,760.

The immediate support is fixed at USD1,772 – 16 Aug’s low – and followed by USD1,753, ie the low of 13 Aug. The immediate resistance remains at the USD1,800 psychological level and followed by USD1,807 – 6 Aug’s high.

Source: RHB Securities Research - 18 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024