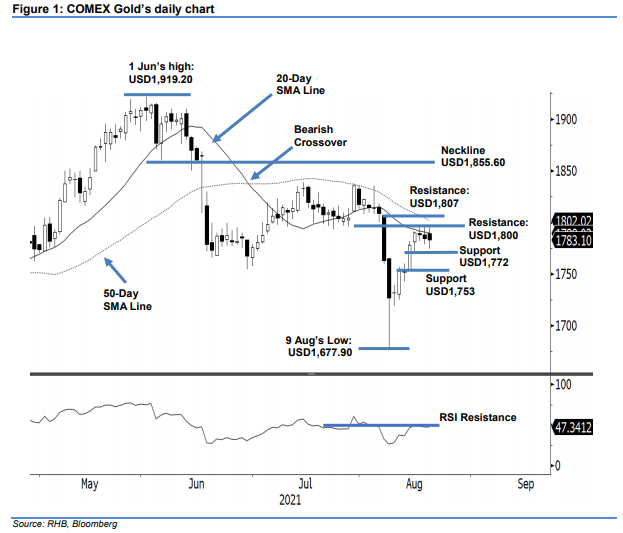

COMEX Gold - Stalled at the 20-Day SMA Line

rhboskres

Publish date: Fri, 20 Aug 2021, 05:43 PM

Maintain long positions. The COMEX Gold stalled at the 20-day SMA line yesterday, inching USD1.30 lower to close at USD1,783.10. It started Thursday’s session stronger at USD1,789.50, but the strong opening did not inspire it to rally higher – it fell to the USD1,774.60 day low. A sudden jump in the mid-session saw the COMEX Gold touch the USD1,795 intraday high, but it softened to close at USD1,783.10 – still not yet crossing the 20-day SMA line. As the RSI was observed as capping below the 50% threshold, this suggests the consolidations may have a longer duration. As long as the commodity stays above the immediate support, it may eventually cross the moving average to test the 1,800-pt psychological level. For now, we keep to our positive trading bias.

Traders should retain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate the downside risks, the stop-loss mark is raised to USD1,765.

The first support remains unchanged at USD1,772 – 16 Aug’s low – and followed by USD1,753, ie the low of 13 Aug. On the upside, the nearest resistance is pegged at the USD1,800 psychological level and followed by the USD1,807 mark, or 6 Aug’s high.

Source: RHB Securities Research - 20 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024