WTI Crude - Breaching Below the USD65.00 Level

rhboskres

Publish date: Fri, 20 Aug 2021, 05:43 PM

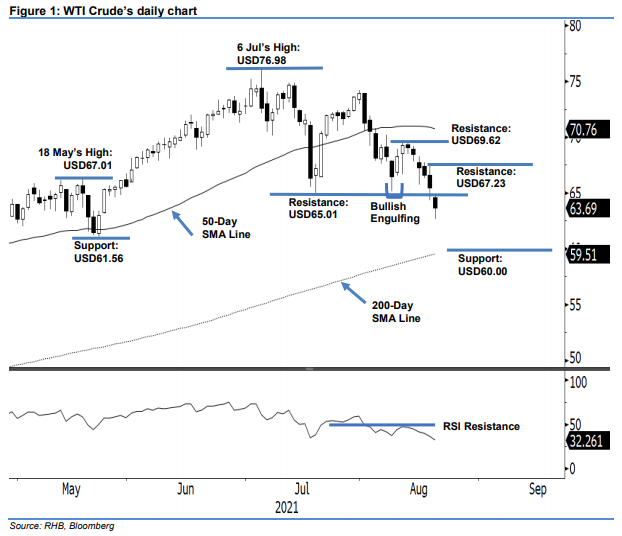

Keep short positions. In line with the recent bearish momentum, the WTI Crude extended its downward movement by breaching its immediate support yesterday. It fell USD1.77 to settle at USD63.69 – negating 10 Aug’s Bullish Engulfing pattern. After opening lower at USD64.58 and bouncing off mildly to tap the USD64.76 day high, the black gold gradually moved lower towards the early US trading hours. This saw it printing the USD62.63 day low. The WTI Crude then bounced off mildly to partially pare the intraday losses and closed at USD63.69. Yesterday’s black body candlestick below the immediate support – post the recent pullback from USD69.62 – signals the bearish momentum is getting more obvious in the coming sessions, ie towards near the 200-day SMA line. In line with the weaker RSI pointing lower near the 30% level, we stick to our bearish trading bias.

We suggest traders maintain the short positions initiated at USD70.50, or 3 Aug’s closing level. To mitigate risks, the trailing-stop level is marked at USD67.23, ie 18 Aug’s high.

The immediate support level is pegged at USD61.56, or 21 May’s low. This is then followed by the USD60.00 round number. The resistance levels are set at USD65.01 – 20 Jul’s low – and USD67.23, ie 18 Aug’s high.

Source: RHB Securities Research - 20 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024