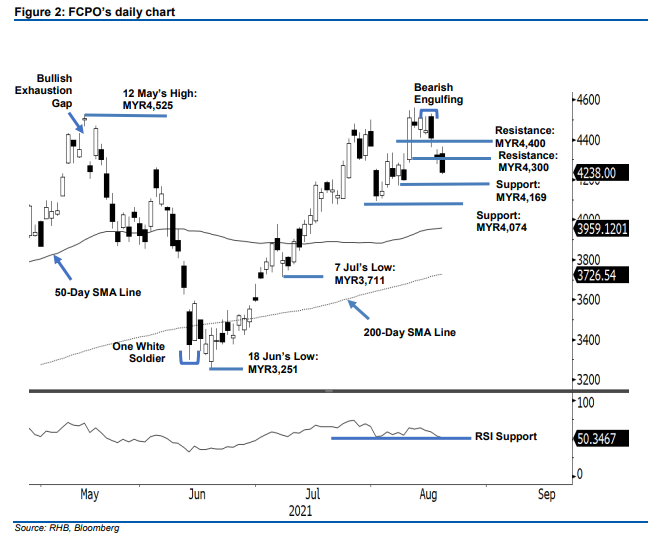

FCPO - Breaching Below The MYR4,300 Level

rhboskres

Publish date: Fri, 20 Aug 2021, 05:44 PM

Stop-loss triggered; initiate short positions. The FCPO saw negative momentum accelerate yesterday, falling MYR63 to settle at MYR4,238 and breaching the previous support at MYR4,300. The commodity initially started Thursday’s session at MYR4,332, then staged an intraday rebound, testing the MYR4,365 day high. However, the brief positive momentum failed to drive the commodity higher as it fell, breaching the MYR4,300 level. It touched the MYR4,226 day low just before the close – forming a long black body candlestick. The Bearish Marubozu candlestick indicates that the correction, which started from the Bearish Engulfing, is in an extension mode now. A follow through action will see the commodity retest the MYR4,169 support level, followed by MYR4,074. Meanwhile, we do not rule out the possibility of the commodity rebounding above the MYR4,300 level. However, to resume an upside movement, it needs to at least surpass MYR4,400. Since the stop-loss has been breached, we shift over to a negative trading bias.

We closed out the long positions, which were initiated at MYR4,511, or the closing level of 11 Aug after the stop-loss at MYR4,300 was triggered. Conversely, we initiate short poitions at the closing level of 19 Aug, ie MYR4,238. For risk management purposes, the initial stop-loss is set at MYR4,450.

The immediate support is shifted to MYR4,169, the low of 6 Aug, followed by MYR4,074, the low of 22 July. Conversely, the immediate resistance is revised to MYR4,300, followed by MYR4,400 round figure

Source: RHB Securities Research - 20 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024