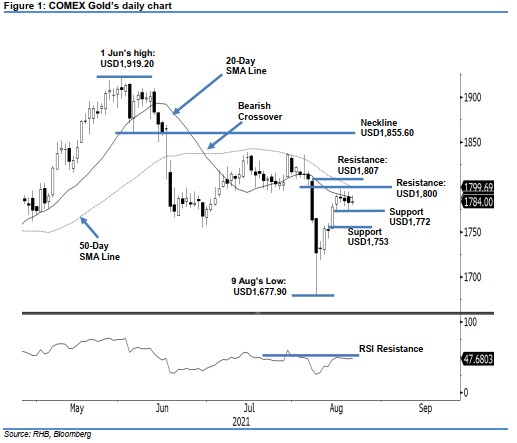

COMEX Gold- Hovering Below the 20-Day SMA Line

rhboskres

Publish date: Mon, 23 Aug 2021, 09:54 AM

Maintain long positions. The COMEX Gold extended its consolidations below the 20-day SMA line last Friday, inching USD0.90 higher to close at USD1,784. The commodity started at USD1,782.80. It swing in-between USD1,791 and USD1,780 before the close. Apparantly, the overhead resistance of the 20-day SMA line is becoming stiffer. If the RSI drifts lower in the coming sessions, the precious metal may be prone to a downside correction and test the USD1,772 support. In the event it crosses above the 20-day SMA line, this may attract further buying pressure. For now, the COMEX Gold is still charting a “higher low” bullish pattern; we believe the bulls will possess a technical advantage. Hence, we retain our positive trading bias until the stop loss is breached.

Traders should maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For risk management, the stop-loss mark is placed at USD1,765.

The nearest support fixed at USD1,772 – 16 Aug’s low – and followed by USD1,753, ie the low of 13 Aug. The immediate resistance is pegged at the USD1,800 psychological level and followed by the USD1,807 mark, or 6 Aug’s high.

Source: RHB Securities Research - 23 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024