Hang Seng Index Futures- 23 August 2021

rhboskres

Publish date: Mon, 23 Aug 2021, 11:22 AM

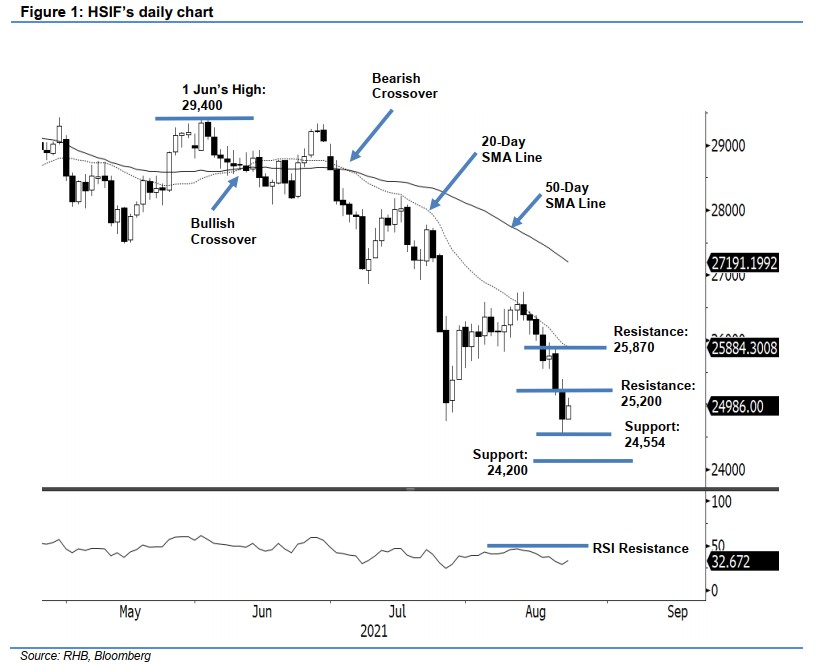

Maintain short positions. The HSIF witnessed the continuation of last Friday’s bearish movement, declining 433 pts to settle the day session at 24,780 pts. The index began this session at 25,347 pts. Sentiment was risk-off, where the HSIF plunged to the 24,554-pt day low during mid-day before rebounding mildly to close with a black body candlestick. During the evening session, the index saw the bears taking profit – it rebounded 206 pts and last traded at 24,986 pts. With a strong performance during the evening session, the HSIF might see follow-through action to reclaim the 25,000-pt level, followed by its 25,200-pt resistance. A sustained move above the resistance may confirm that it found an interim base at the 24,554-pt support mark. Otherwise, breaching the support may attract more selling pressure and further downside risks. We keep our negative trading bias until the stop loss is triggered.

Traders should keep to the short positions we initiated at 25,683 pts, or the closing level of 17 Aug. To manage the trading risks, the stop-loss threshold is lowered to 25,870 pts.

The immediate support is revised to 24,554 pts – 20 Aug’s – and followed by the 24,200-pt round figure. The immediate resistance is pegged at the 25,200-pt whole number, followed by 25,870 pts, ie 19 Aug’s high.

Source: RHB Securities Research - 23 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024