FCPO- Bears Taking a Breather

rhboskres

Publish date: Mon, 23 Aug 2021, 12:55 PM

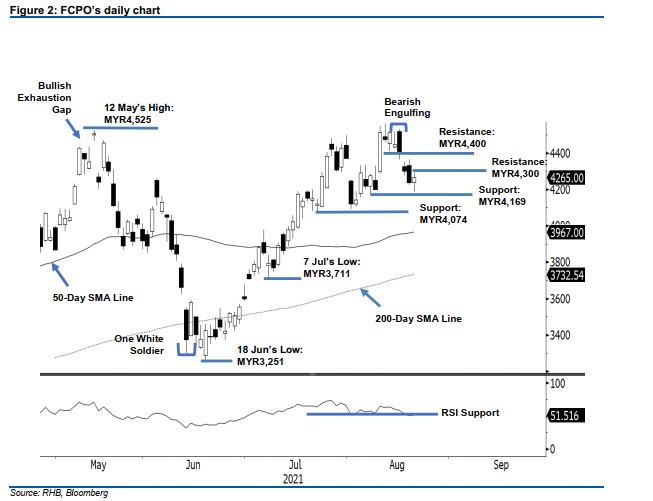

Maintain short positions. The FCPO saw the bears taking a breather last Friday, rebounding MYR27 to settle at MYR4,265. After heavy selling on Thursday, the commodity started Friday’s session flat at MYR4,237 and rose to test the intraday high of MYR4,292. After resuming trading in the afternoon, heavy selling pressure reemerged, dragging the commodity to touch the MYR4,187 day low before rebounding strongly to close at MYR4,265. The latest candlestick suggests that the bulls are defending the MYR4,169 immediate support level. If that support level gives way, it may lead to stronger selling pressure. On the other hand, breaching above the nearest resistance or the MY4,300 level may witness a fresh “higher high” bullish pattern. Since the RSI is pointing downwards, indicating weak momentum ahead, we keep to our negative trading bias until the stop-loss is breached.

We recommend traders mainatin their short positions initiated at MYR4,238, or the closing level of 19 Aug. To mitigate trading risks, the initial stop-loss is set at MYR4,450.

The first support is marked at MYR4,169, the low of 6 Aug, followed by MYR4,074, the low of 22 July. Towards the upside, the immediate resistance is sighted at MYR4,300, followed by the MYR4,400 round figure.

Source: RHB Securities Research - 1 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024