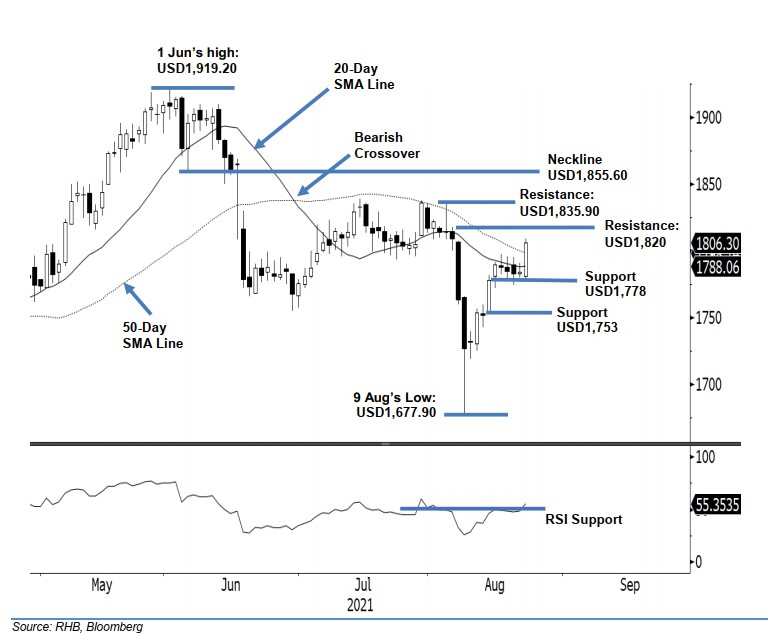

COMEX Gold- Crossing Above the 20-Day SMA Line

rhboskres

Publish date: Tue, 24 Aug 2021, 09:50 AM

Maintain long positions. The COMEX Gold jumped above the 20-day SMA line on the first trading day of the week, surging USD22.30 to settle at USD1,806.30. It started Monday’s session at USD1,781.20. After touching the session’s low of USD1,778, it reversed to reach the USD1,809.10 session high, just before the close. The latest long white candlestick pattern indicates that the consolidation is complete, and the COMEX Gold has resumed its upward movement. As long as it sustains above the 20-day SMA line, the bulls may look to extend their upside movement and test the USD1,820 immediate resistance. Given the renewed momentum, we maintain our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate downside risks, the stop-loss is raised to USD1,772.

The first support is marked at USD1,778, or the low of 23 Aug, followed by USD1,753, which was 13 Aug’s low. The nearest resistance is pegged at the USD1,820 round number, followed by USD1,835.90, or the high of 4 Aug.

Source: RHB Securities Research - 24 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024