WTI Crude- Climbing Back Above the USD65.00 Level

rhboskres

Publish date: Tue, 24 Aug 2021, 09:52 AM

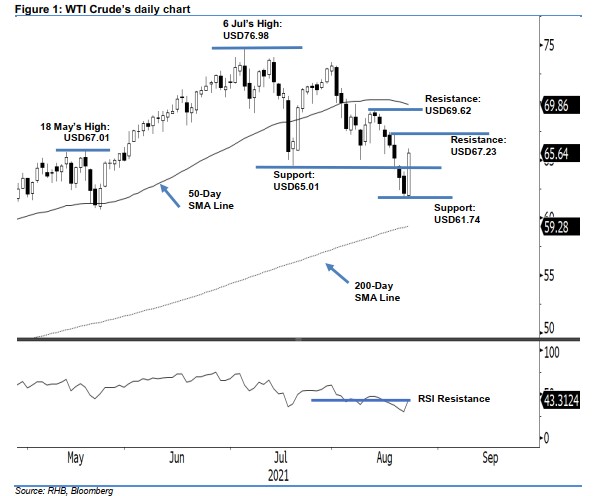

Maintain short positions. The WTI Crude saw a strong reversal yesterday, surging USD3.50 to settle at USD65.64. It opened Monday’s session at USD61.96. After touching the session’s USD61.74 low, strong buying momentum lifted it to the session’s USD66.00 high before the close. The latest long white candlestick pattern has engulfed the two previous sessions’ bearish candlesticks – indicating a swing to optimistic sentiment once again. If the RSI can cross the 50% threshold, we may see follow-through price action to test the USD67.23 immediate resistance. A breach of this level will see the commodity reverting to upward trajectory. However, we expect selling pressure to emerge near the resistance. We will keep our bearish trading bias until the trailing-stop is breached.

We recommend traders maintain the short positions initiated at USD70.50, or 3 Aug’s closing level. To mitigate risks, the trailing-stop is marked at USD67.23, or 18 Aug’s high.

The immediate support level is set at USD65.01, or 20 Jul’s low, followed by USD61.74 (23 Aug’s low). The nearest resistance is pegged at USD67.23, or 18 Aug’s high, followed by the higher hurdle at USD69.62, or 12 Aug’s high.

Source: RHB Securities Research - 24 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024