E-Mini Dow- Testing the Immediate Resistance

rhboskres

Publish date: Tue, 24 Aug 2021, 09:53 AM

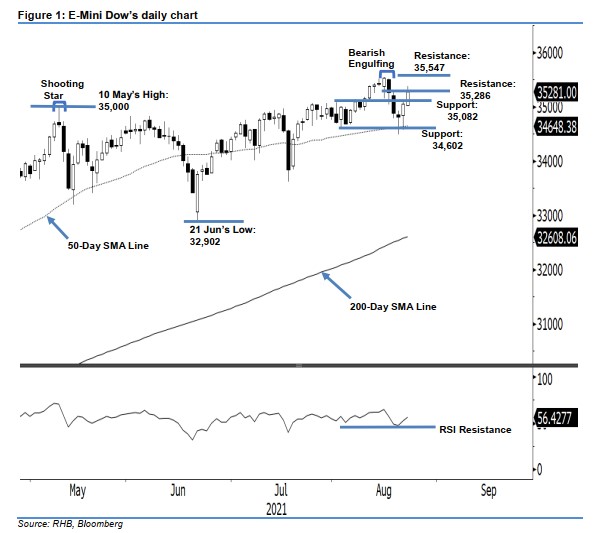

Maintain short positions. The E-Mini Dow saw extended bullish momentum on the first trading day of the week, rising 223 pts to settle at 35,281 pts. The index opened on a positive note yesterday, at 35,031 pts. It barely touched the 35,016-pt day low, before progressing higher to the 35,373-pt day high. It closed at 35,281 pts after printing a long white candlestick pattern. The latest session signifies that the bulls have overpowered the bears, and may see follow-through momentum in coming sessions. The index may attempt to cross the 35,286-pt immediate resistance, followed by the Bearish Engulfing pattern’s high of 35,547 pts. Meanwhile, the index has formed a strong support at the 50-day SMA line or 34,602 pts. Despite yesterday’s strong momentum, it has yet to cross the stop-loss, and so, we maintain our negative trading bias.

Traders should keep the short positions initiated at the closing level of 18 Aug, or 34,887 pts. To mitigate trading risks, the stop-loss threshold is set at 35,286 pts, or 18 Aug’s high.

The immediate support is revised to 35,082 pts, or 2 Aug’s high, with the lower support at 34,602 pts, or 3 Aug’s low. The immediate resistance is pegged at 35,286 pts – 18 Aug’s high – followed by 16 Aug’s high of 35,547 pts.

Source: RHB Securities Research - 24 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024