COMEX Gold- Mild Consolidation

rhboskres

Publish date: Wed, 25 Aug 2021, 11:26 AM

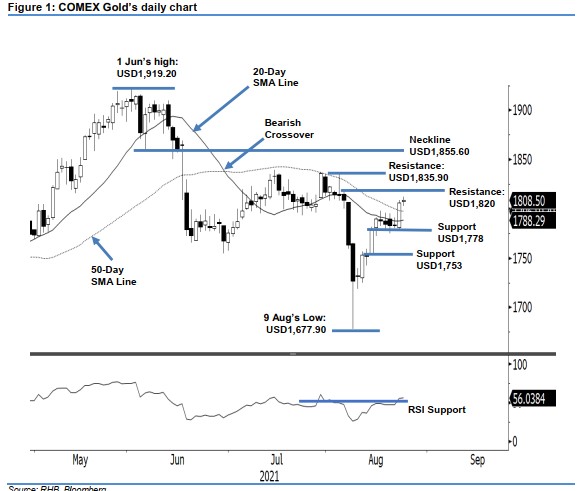

Maintain long positions. After a sharp rally, the COMEX Gold’s upside movement took a pause for consolidation. It rose USD2.20 yesterday to settle at USD1,808.50. The commodity initially opened at USD1,807.60. Despite a strong opening, it did not manage to extend the positive movement, trading in a narrow range of USD1,812.20 and USD1,802.60 before the close. With the latest neutral candlestick pattern, the yellow metal will consolidate sideways before resuming its bullish momentum. As long as it stays above the 20-day SMA line, the bullish structure of “higher highs and higher lows” will be retained. Hence, we keep to our positive trading bias.

Traders should retain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To control the trading risks, the stop-loss level is set at USD1,772.

The nearest support remains at USD1,778 – 23 Aug’s low – followed by USD1,753, which was 13 Aug’s low. The immediate resistance is eyed at the USD1,820 round number and then the higher hurdle of USD1,835.90, ie the high of 4 Aug

Source: RHB Securities Research - 25 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024