Hang Seng Index Futures: Shifting to a Bullish Momentum

rhboskres

Publish date: Wed, 25 Aug 2021, 11:30 AM

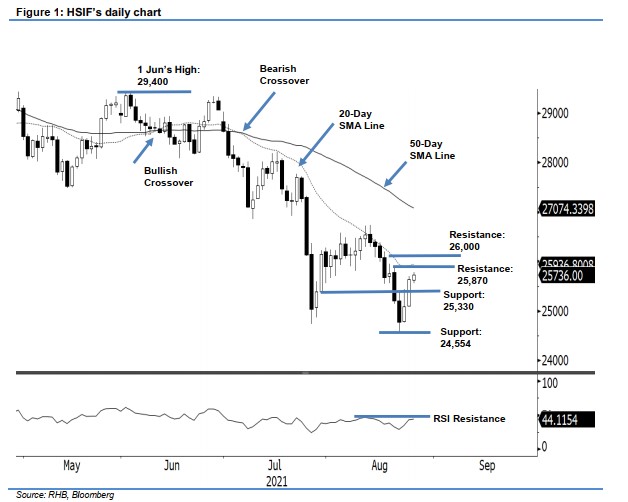

Trailing-stop level triggered; initiate long positions. The HSIF extended the technical rebound yesterday, advancing 554 pts to settle the day session at 25,638 pts. It started Tuesday’s session at 25,380 pts and progressed higher. At one point, it pulled back from the 25,444-pt resistance level. The bullish momentum accelerated in the afternoon, propelling the HSIF to breach the resistance – it reached the 25,706-pt day high before the close. During the evening session, the index continued marching 98 pts to close at 25,736 pts. The latest session printed a “higher high” bullish pattern and it is poised to test the 50-day SMA line. Crossing this overhead resistance will lead the HSIF to reach the 26,000-pt psychological level. Since the trailing stop is breached, we shift to a positive trading bias.

We closed out the short positions initiated at 25,683 pts, or the closing level of 17 Aug, after the trailing-stop mark at 25,444 pts was triggered. Conversely, we initiate long position at the closing level of 24 Aug’s day session, ie 25,638 pts. To mitigate the downside risks, the initial stop-loss threshold is placed at 24,766 pts.

The immediate support is marked at 25,330 pts – 29 Jul’s low – and followed by 24,554 pts, 20 Aug’s low. The immediate resistance is pegged at 25,870 pts – 19 Aug’s high – and followed by the 26,000-pt psychological level.

Source: RHB Securities Research - 25 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024