WTI Crude- Uptrend Reversal Continues – Breaching USD67.00

rhboskres

Publish date: Wed, 25 Aug 2021, 11:35 AM

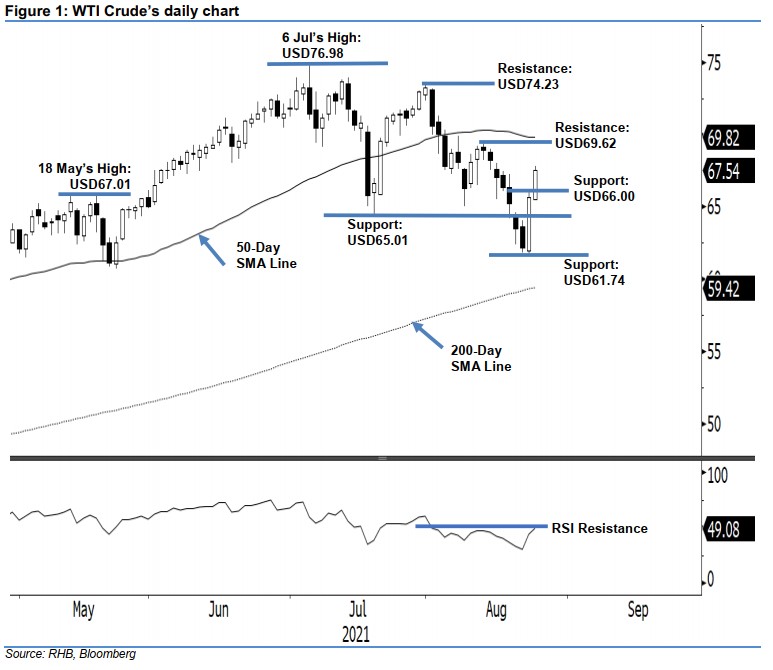

Trailing stop triggered; initiate long positions. The WTI Crude continued its uptrend reversal yesterday by jumping USD1.90 to close at USD67.54. Although it opened weaker at USD65.54 and touched the USD65.41 day low, the buying pressure kicked in early during the Asian trading hours and sustained towards the end of the session – it reached the USD67.80 day peak before the close. The long white candlestick that breached the USD67.23 immediate resistance – the previous trailing-stop level – suggests the bullish momentum is getting more obvious in sustaining towards the 50-day SMA line. The sharp increase of the RSI towards near the 50% threshold signals that the bulls are on the move. Since it has breached the trailing stop, we shift our bearish trading bias to bullish.

We closed out the short positions – initiated at USD70.50, or 3 Aug’s closing level – after the trailing-stop mark at USD67.23 was triggered. Conversely, we initiate long positions at the closing level of 24 Aug, ie USD67.54. To mitigate risks, the initial stop-loss threshold is marked at USD65.01, or 20 Jul’s low.

The immediate support level is pegged at USD66.00, or 23 Aug’s high, and followed by USD65.01, ie 20 Jul’s low. The nearest resistance is pegged at USD69.62 – 12 Aug’s high – and followed by the higher hurdle at USD74.23, ie 30 Jul’s high.

Source: RHB Securities Research - 25 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024