FKLI- Eyeing The 200-Day SMA Line

rhboskres

Publish date: Thu, 26 Aug 2021, 01:00 PM

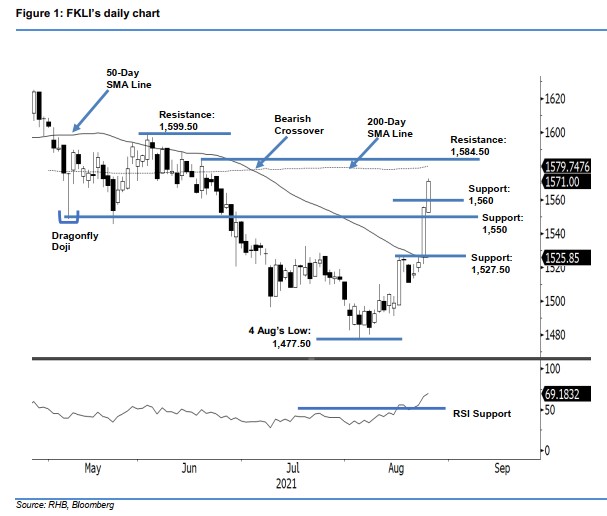

Maintain long positions. Bullish momentum on the FKLI picked up yesterday, and the index gained 15.50 pts to close at 1,571 pts – recording back-to-back positive sessions since breaking past the 50-day SMA line. The index started Wednesday’s session at 1,552.50 pts. It surged to test the intraday high at 1,572.50 pts, then retraced mildly on profittaking acitvities. In the afternoon session, it swung north again to close with a long white candlestick. As the momentum is running on full throttle, the FKLI may trend up further to test the 200-day SMA line. Breaching the moving average may see it negating the Bearish Crossover, strengthening the technical set-up. Meanwhile, expect profit-taking or selling pressure to emerge near the 1,584.50-pt resistance. As long as the index continues to trade above the trailing-stop, we make no change to our positive trading bias.

Traders should stick to long positions, which were initiated at 1,524 pts, or the close of 17 Aug. To mitigate trading risks and protect profits, we raise the trailing-stop to 1,545 pts whole number.

The immediate support is marked at 1,560 pts followed by 1,550 pts round number. The immediate resistance is at 1,584.50 pts or the high of 18 Jun, followed by the higher resistance of 1,599.50 pts or the 2 Jun’s high.

Source: RHB Securities Research - 25 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024