WTI Crude- Rising for the Third Consecutive Session

rhboskres

Publish date: Thu, 26 Aug 2021, 11:36 AM

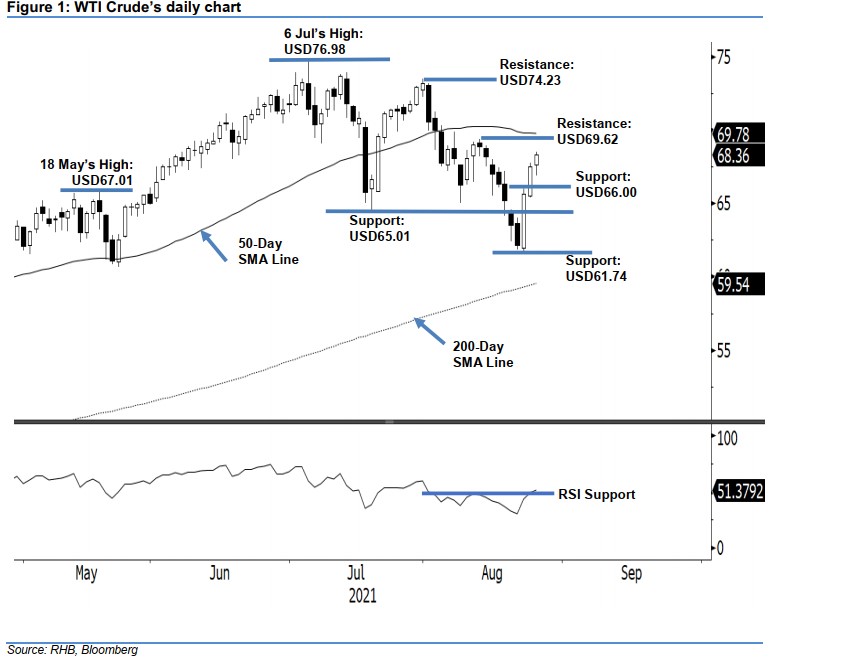

Maintain long positions. The WTI Crude printed its third consecutive bullish session yesterday, as it rose USD0.82 to close at USD68.36 after recouping its intraday losses. Although it began on a positive note at USD67.63, the bears dominated the Asian trading hours, dragging the commodity to the day’s low of USD66.92. Strong buying pressure then emerged, lifting it towards the day’s peak of USD68.54 before retracing mildly to close. The white body candlestick with long lower shadow, printed after the two consecutive bullish candles, suggests that bullish momentum remains intact – buying interest is now more evident after bouncing off yesterday’s intraday low. Coupled with the RSI breaching above the 50% threshold, this signifies that the bulls are still in the driver’s seat. As such, we shift to a bullish trading bias.

Traders should maintain the long positions initiated at the closing level of 24 Aug, or USD67.54. To mitigate risks, the initial stop-loss threshold is pegged at USD65.01, or 20 Jul’s low.

The support levels are unchanged at USD66.00, or 23 Aug’s high, and USD65.01, which was 20 Jul’s low. The immediate resistance is set at USD69.62 (12 Aug’s high), followed by the higher resistance at USD74.23, or 30 Jul’s high.

Source: RHB Securities Research - 26 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024