E-Mini Dow- Hovering Near the Immediate Support

rhboskres

Publish date: Thu, 26 Aug 2021, 11:37 AM

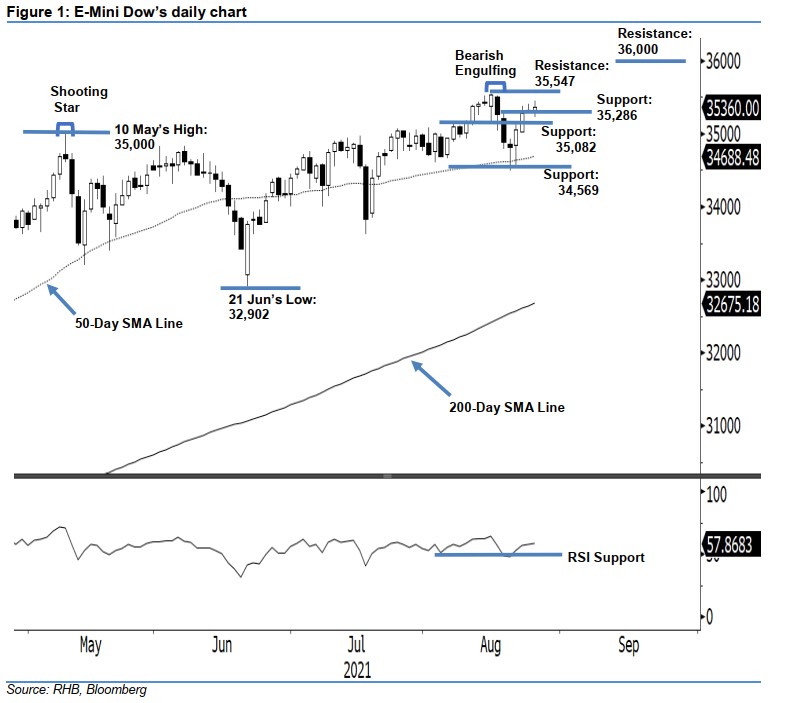

Maintain long positions. Yesterday, the E-Mini Dow recouped all its intraday losses to close 46 pts higher at 35,360 pts – staying above the immediate support. It opened slightly higher, at 35,326 pts, and whipsawed sideways until the start of the US trading session – touching the 35,229-pt day low. The bearish momentum then turned bullish, lifting the index towards the day’s peak of 35,445 pts before retracing strongly to close above the opening level. The latest candlestick – a white body with equal upper and lower shadow length – above the immediate support level, signals that bullish momentum remains intact, albeit mild, above the immediate support of 35,286 pts. We do not rule out the possibility of profit-taking in the coming sessions. The 35,082-pt level will act as a strong support. We shift to a positive trading bias.

We recommend traders stay in the long positions initiated at the closing level of 24 Aug, or 35,314 pts. For risk management, the initial stop-loss is marked below 35,000 pts. The immediate support is kept at 35,286 pts, or 18 Aug’s high, followed by 35,082 pts, which was 2 Aug’s high.

The immediate resistance is set at 35,547 pts, or 16 Aug’s high, with the higher resistance at the 36,000-pt round figure.

Source: RHB Securities Research - 26 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024