FCPO- Bullish Momentum Picking Up Pace

rhboskres

Publish date: Thu, 26 Aug 2021, 01:00 PM

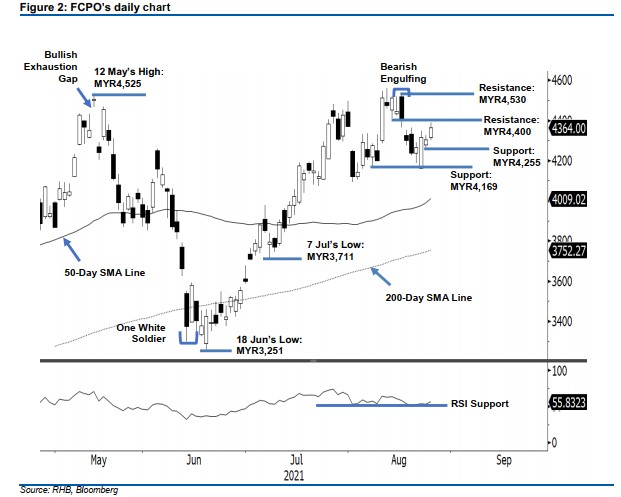

Maintain short positions. Despite a choppy intraday session, the FCPO managed to add 61 pts yesterday to close stronger at MYR4,364 – just MYR36.00 shy of the MYR4,400 resistance. The commodity initially opened at MYR4,318. It rose to test the day’s high of MYR4,388 before retracing in the afternoon to graze the day’s low of MYR4,300. At the eleventh hour, it pared intraday losses and jumped to close at MYR4,364. The latest session shows that the bulls have a technical advantage by printing a “higher low” bullish pattern. The RSI indicator is rounding up, underlining the implication that positive momentum is picking up pace. If the commodity breaches the MYR4,400 resistance, it may rise further to negate the Bearish Engulfing pattern. As the immediate resistance or the stop-loss threshold is intact now, we will stick to a negative trading bias.

Traders should remain in the short positions, which were initiated at MYR4,238, or the closing level of 19 Aug. For risks management purposes, the stop-loss is at MYR4,400.

The immediate support has been revised to MYR4,255 – the low of 24 Aug. This is followed by MYR4,169, or 6 Aug’s low. Conversely, the nearest resistance is still within sight of the MYR4,400 round figure, and then MYR4,530 or the high of 17 Aug.

Source: RHB Securities Research - 1 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024