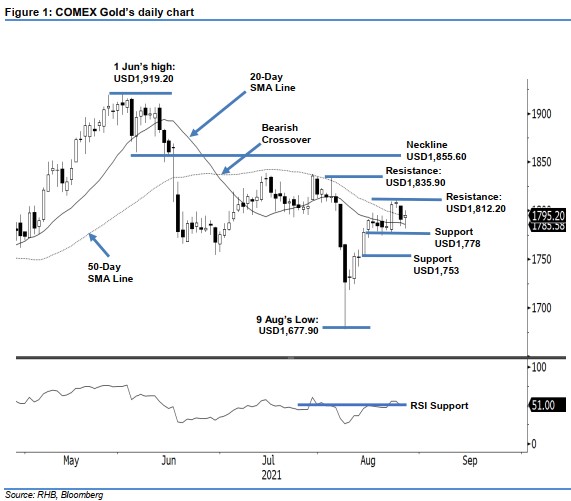

COMEX Gold- Bouncing Off the 20-Day SMA Line

rhboskres

Publish date: Fri, 27 Aug 2021, 05:32 PM

Maintain long positions. The COMEX Gold saw mild rebound from the 20-day SMA line yesterday, rising USD4.20 to settle at USD1,795.20. After it opened at USD1,793 on Thursday, the commodity slid to test the intraday low at USD1,781.30. Strong buying interest near the moving average sent it back into positive territory, reaching the USD1,800.40 day high before the close. Although the COMEX Gold is seen as consolidating sideways just above 20-day SMA line, we expect volatility to pick up during Friday’s session. If it crosses above the 50-day SMA line, the commodity may climb further to test the immediate resistance. Meanwhile, USD1,778 will provide strong support if selling pressure arises. As of now, we hold on to our positive trading bias.

We advise traders to maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate the downside risks, the stop-loss threshold is placed at USD1,772.

The first support remains unchanged at USD1,778 – 23 Aug’s low – followed by USD1,753, which was 13 Aug’s low. The nearest resistance is kept at USD1,812.20 – 24 Aug’s high – and is followed by the higher resistance of USD1,835.90, or the high of 4 Aug.

Source: RHB Securities Research - 27 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024