WTI Crude- Bullish Momentum Paused

rhboskres

Publish date: Fri, 27 Aug 2021, 05:35 PM

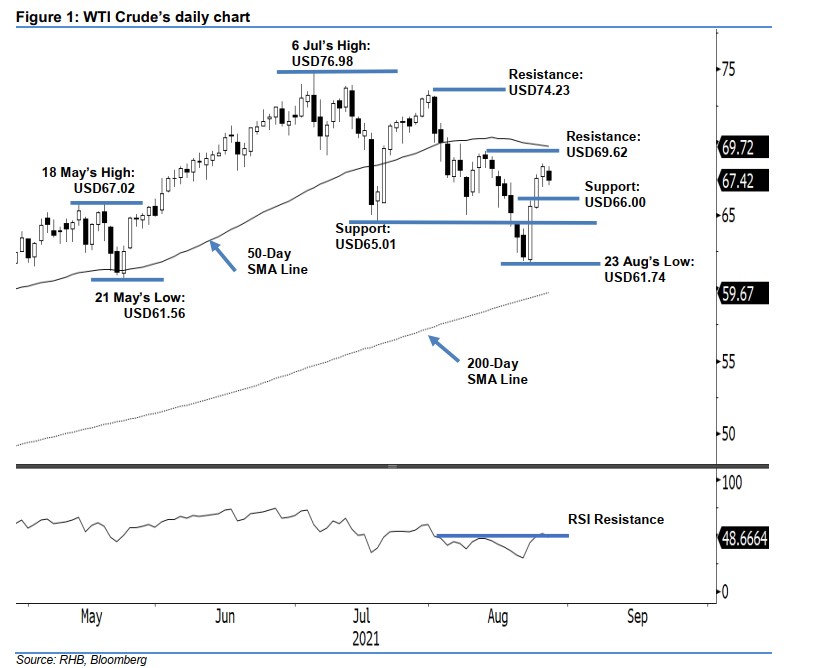

Maintain long positions. After rallying for three consecutive sessions, the WTI Crude paused its momentum for mild profit-taking activities yesterday as it inched USD0.94 lower to close at USD67.42. It started weaker at USD68.00 before whipsawing throughout the session. High volatility was seen during the US trading hours – it jumped to the USD68.31 day high but swiftly shifted direction towards the USD67.02 day low. The black body candlestick with equal lengths of upper and lower shadows printed yesterday suggest the bulls are taking a breather on mild profit-taking. The bullish bias is expected to remain above the USD66.00 immediate support. As indicated by the RSI turning below the 50% threshold, the immediate strength is weakening, raising the odds of profit-taking to continue in the coming sessions. Unless it breaches below the stop-loss level, we stick to a bullish trading bias.

Traders should stay in the long positions initiated at the closing level of 24 Aug, or USD67.54. To mitigate risks, the initial stop-loss threshold is set at USD65.01, or 20 Jul’s low.

The support levels are at USD66.00, which was 23 Aug’s high, and USD65.01, ie 20 Jul’s low. The immediate resistance is set at USD69.62 – 12 Aug’s high – and followed by the next resistance at USD74.23, or 30 Jul’s high.

Source: RHB Securities Research - 27 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024