COMEX Gold: Climbing Above the USD1,800 Level

rhboskres

Publish date: Mon, 30 Aug 2021, 04:39 PM

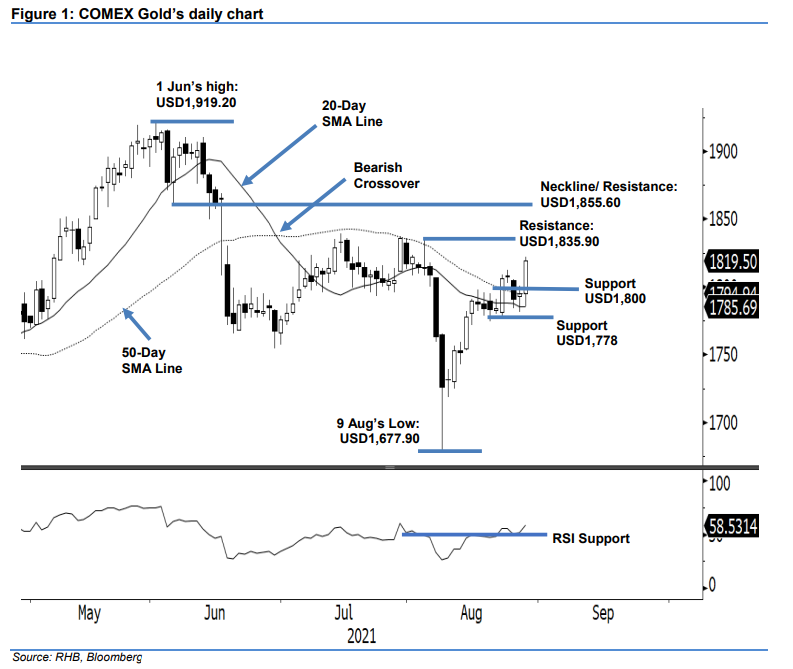

Maintain long positions. As anticpated, the COMEX Gold’s volatility picked up last Friday, surging USD24.30 to settle at USD1,819.50. It initially opened at USD1,795.20 and moved sideways for most of the session. It then reacted positively towards the latest speech by Federal Reserve Chairman Jerome Powell – surging from the low of USD1,785.20 to test the USD1,821.90 intraday high. The commodity then closed near its day high to form a long white candlestick. With the RSI currently rouding up, we may see follow-through price action that tests August’s high or the USD1,835.90 level. Breaching this level will see the COMEX Gold logging a fresh 2-month high and attract more buying pressure. Conversely, the technical setup will be further enhanced if the 20-day SMA line crosses above the 50-day one. At this stage, we retain our positive trading bias.

We recommend traders stick with the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate the downside risks, the stop-loss threshold is pegged at USD1,778.20, ie the breakeven point.

The nearest support is sighted at the USD1,800 psychological level and followed by USD1,778, or 23 Aug’s low. On the upside, the first resistance is eyed at USD1,835.90 – 4 Aug’s high – and followed by the higher hurdle of USD1,855.60, ie the neckline that formed in early June.

Source: RHB Securities Research - 30 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024