WTI Crude: Uptrend Momentum Continues

rhboskres

Publish date: Mon, 30 Aug 2021, 04:40 PM

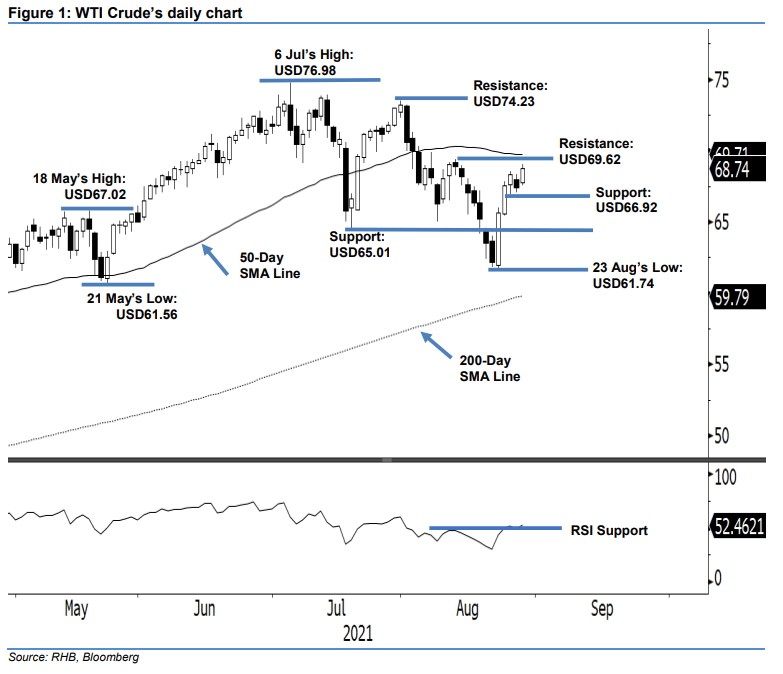

Maintain long positions. The WTI Crude resumed its upward movement last Friday to close USD1.32 higher at USD68.74, as it eyed testing its 50-day SMA line. The black gold began with a positive tone at USD67.75, but fell slightly to tap its day bottom at USD67.52 before bouncing off higher throughout the session – it hit the day high of USD69.05 at the start of the US trading hours before retracing mildly towards the close. The long white candlestick signalled that the bulls are in the driver’s seat now – it is now possible to witness a follow-through price action towards the USD69.62 level in the immediate term. As the WTI Crude approaches the immediate resistance level, the bears may attempt to take profits. In the event this happens, USD66.92 will offer immediate support. At this stage, the RSI is strengthening above the 50% threshold, enhancing the probability of seeing a continuation of the upside movement. We stay with our positive trading bias until the stop-loss mark is breached.

Traders should maintain the long positions initiated at the closing level of 24 Aug, or USD67.54. To mitigate risks, the stop-loss threshold is revised higher to USD66.92, ie 25 Aug’s low.

The immediate support level is revised higher at USD66.92 – 25 Aug’s low – and followed by USD65.01, or 20 Jul’s low. The resistance levels are unchanged at USD69.62 – 12 Aug’s high – and USD74.23, ie 30 Jul’s high.

Source: RHB Securities Research - 30 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024