FKLI & FCPO - 30 August 2021

rhboskres

Publish date: Mon, 30 Aug 2021, 04:41 PM

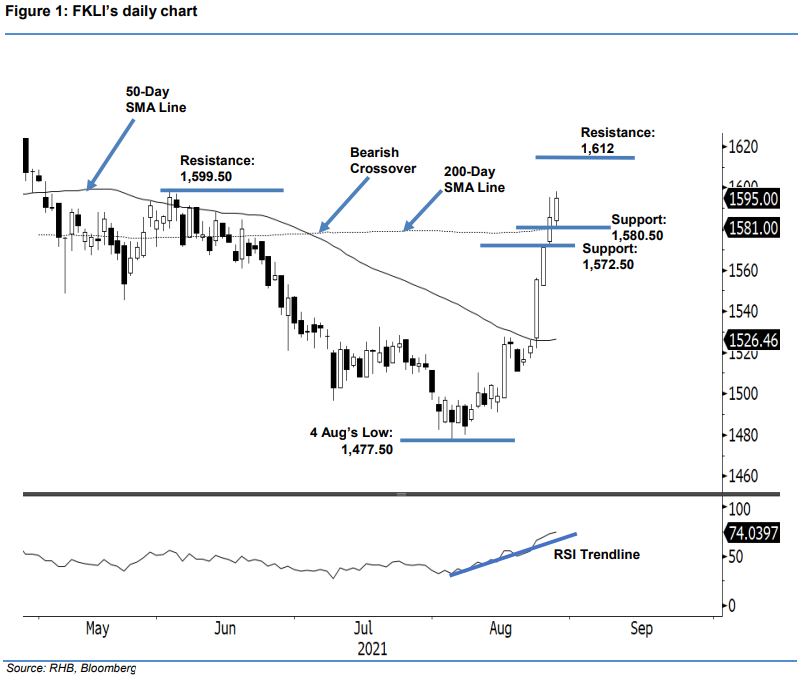

Maintain long positions. The FKLI saw the bulls charging higher last Friday, advancing 9.5 pts to settle at 1,595 pts – a level last seen in 3 June. The index began with cautious sentiment, opening at 1,584 pts. After some whipsaw price action during the early session, the index managed to establish the day’s high at 1,598 pts and day’s low at 1,580.50 pts. The FKLI then gyrated near its day’s higher before closing. The latest price action showed the index forming a strong closing above the 200-day SMA line amid posititve momentum. As long as it continues to trade above the moving average, it should soon reclaim the 1,600-pt psychological level. Meanwhile, we do expect mild profit taking on Monday’s session since the August futures contract is expiring. For now, we still stick to our positive trading bias.

Traders are advised to hold on to their long positions, which were initiated at 1,524 pts, or the close of 17 Aug. To minimise the downside risks and protect profits, we peg the trailing-stop higher to 1,572.50 pts – just beneath the 200- day SMA line.

The immediate support is marked at 1,580.50 pts – the low of 27 Aug – followed by 1,550 pts. The immediate resistance is eyed 1,599.50 pts, 2 Jun’s high. The higher hurdle will be pegged at 1,612 pts, the high of 23 Apr.

Source: RHB Securities Research - 30 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024