COMEX Gold: Consolidating Sideways

rhboskres

Publish date: Wed, 01 Sep 2021, 04:52 PM

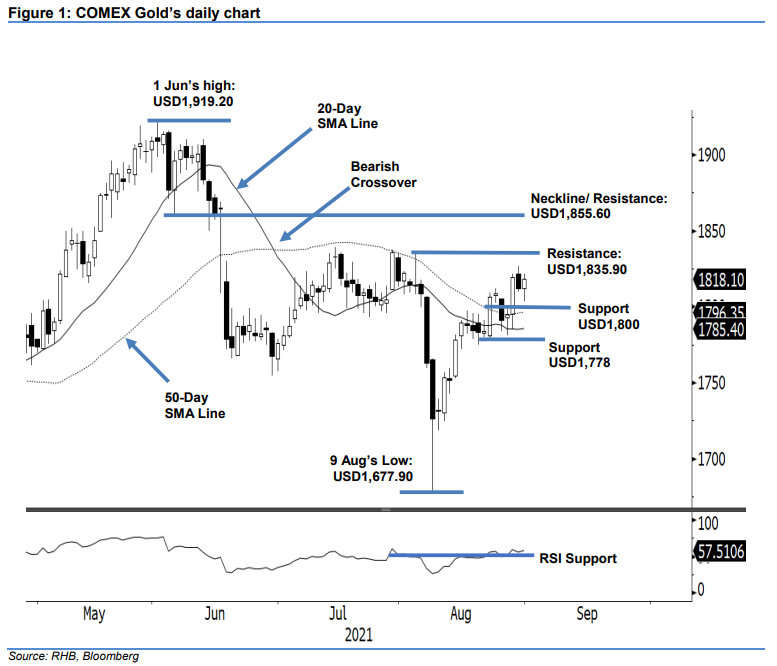

Maintain long positions. After breaking above USD1,800, COMEX Gold started to drift sideways yesterday for consolidations. It rose USD5.90 to settle at USD1,818.10. The commodity started Tuesday’s session at USD1,812.20. After oscillating between USD1,821.90 and USD1,803.40, it closed at USD1,818.10 – printing a white candlestick with long lower shadow. The latest session showed the COMEX Gold was still moving on a “higher highs and higher lows” bullish pattern, and the uptrend is deemed intact. The yellow metal may pull back to retest 1,800-pt level or the 50-day SMA line if the bears continue to take profits – expect buying pressure to emerge near the moving average. With the bullish structure still intact, we keep to our positive trading bias.

Traders should retain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For trading-risk management, the stop-loss threshold is set at USD1,778.20, ie the breakeven point.

The nearest support is kept at the USD1,800 the psychological level and followed by USD1,778, or 23 Aug’s low. The first resistance is seen at USD1,835.90 – 4 Aug’s high – and followed by the higher resistance of USD1,855.60, ie the neckline that formed in early June.

Source: RHB Securities Research - 1 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024