E-Mini Dow: Consolidating Before the Immediate Resistance

rhboskres

Publish date: Wed, 01 Sep 2021, 04:55 PM

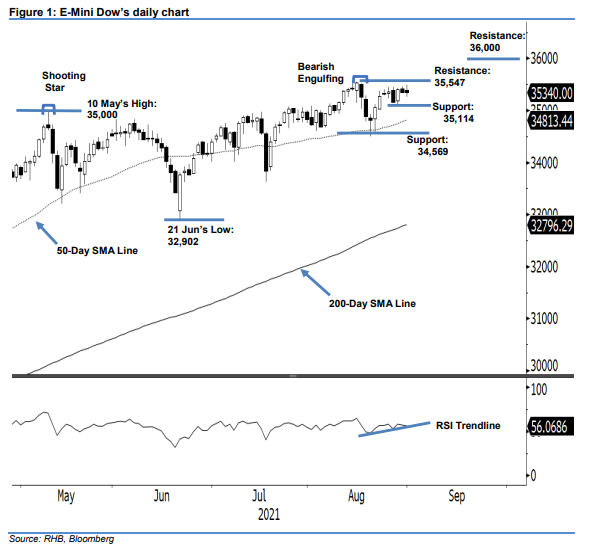

Maintain long positions. The E-Mini Dow attempted to test its immediate resistance yesterday but was dragged by the bears during the intraday session. It fell 12 pts to close at 35,340 pts. The index began stronger at 35,395 pts to test the 35,492-pt day high during the mid-trading session. Selling pressure then emerged to drag it lower towards the US trading session, which saw the E-Mini Dow bottoming at 35,258 pts before bouncing off mildly and whipsawing to close below the opening. The latest black body candlestick with upper shadows signal that the upward movement, which started from USD35,114, is taking a pause – expect consolidations before retest the immediate resistance. Taking a cue from the RSI, which is trending higher above the 50% mark, we believe the medium-term momentum will stay intact as long as the index continues to print a “higher low” bullish pattern while consolidating. As such, we continue to stay with our bullish trading bias.

We suggest traders maintain the long positions initiated at the closing level of 24 Aug, or 35,314 pts. For risk management, the initial stop-loss threshold is set below 35,114 pts, or the immediate support.

The nearest support is unchanged at 35,114 pts – 27 Aug’s low – then followed by 34,569 pts, ie 20 Aug’s low. The immediate resistance is pegged at 35,547 pts, or 16 Aug’s high, and followed by the 36,000-pt new high level.

Source: RHB Securities Research - 1 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024