FKLI: Crossing Above 1,600 Pts

rhboskres

Publish date: Wed, 01 Sep 2021, 04:57 PM

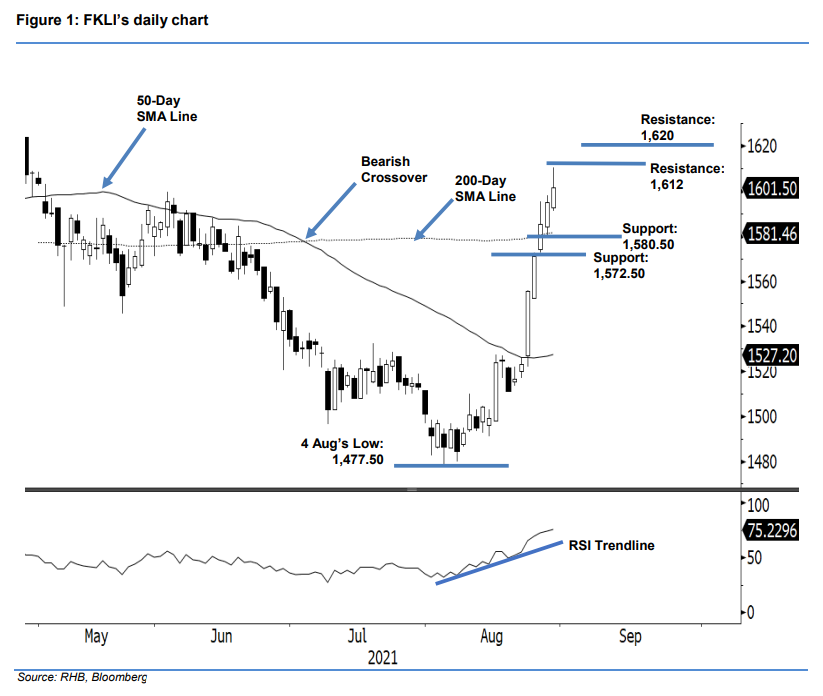

Maintain long positions. The FKLI extended its rally for the fifth consecutive session, rising by 6.5 pts to settle at 1,601.50 pts – printing a fresh 3-month high since June. After the index opened at 1,592.50 pts on Monday, it oscillated between 1,591 pts and 1,610.50 pts. Despite some profit-taking activities early in the session, the risk-on sentiment prevailed and lifted the index to close above the 1,600-pt psychological level. As the momentum has picked up pace lately – evidenced by the RSI trending upwards – we expect the positive price action to follow though in the days ahead. However, if the bears continue to take profit, expect a retracement to test the 1,580.50 pt-level. As long as the index hold on 200-day SMA line or at least keeping trailing-stop intact, we will maintain positive trading bias.

Traders should stick to long positions, which were initiated at 1,524 pts or the close of 17 Aug. To mitigate the downside risks, the trailing-stop is set at 1,572.50 pts – a level below the 200-day SMA line.

The immediate support is at 1,580.50 pts – the low of 27 Aug – followed by 1,572.50 pts or 26 Aug’s low. Conversely, the immediate resistance is projected at 1,612 pts or the high of 23 Apr, followed by the higher resistance of 1,620 pts.

Source: RHB Securities Research - 1 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024