FCPO: Breaching Below MYR4,300

rhboskres

Publish date: Wed, 01 Sep 2021, 04:57 PM

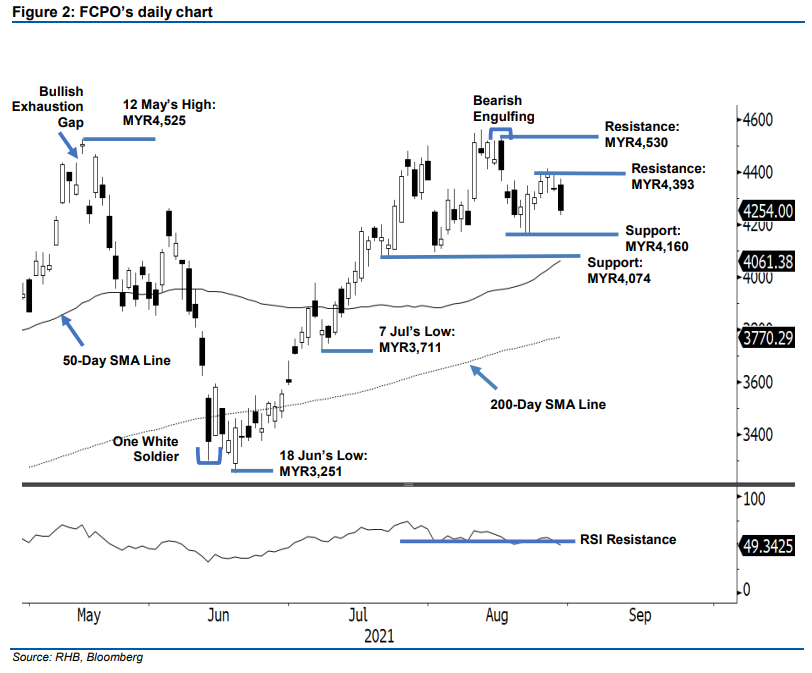

Maintain short positions. The FCPO underwent another bearish session on Monday, correcting MYR79.00 to close weaker at MYR4,254 – falling below the MYR4,300 level. On Monday, it opened at MYR4,350. After touching the day’s high of MYR4,374, it drifted lower amid profit-taking, testing the MYR4,235 level before closing. The latest black body candlestick showed that the bears have returned to the market, and indicates that the mini-rally that started from MYR4,160 has ended. The commodity may move lower in immediate sessions to retest the recent low of MYR4,160. Breaching this level or the low of Aug will see the FCPO correct further towards the 50-day SMA line. As the RSI is also falling below the 50% threshold – thereby confirming that a further correction is imminent – we make no change to our negative trading bias.

We recommend that traders hold on to short positions, which were initiated at MYR4,238 or the closing level of 19 Aug. To manage risks, the stop-loss is set at MYR4,393 or the high of 27 Aug.

The first support has been revised to MYR4,160 or the low of 23 Aug, then MYR4,074 or the low of 22 Jul. Towards the upside, the nearest resistance remains at MYR4,393, then MYR4,530 or the high of 17 Aug.

Source: RHB Securities Research - 1 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024