WTI Crude: Bouncing Off From the Immediate Support

rhboskres

Publish date: Thu, 02 Sep 2021, 05:26 PM

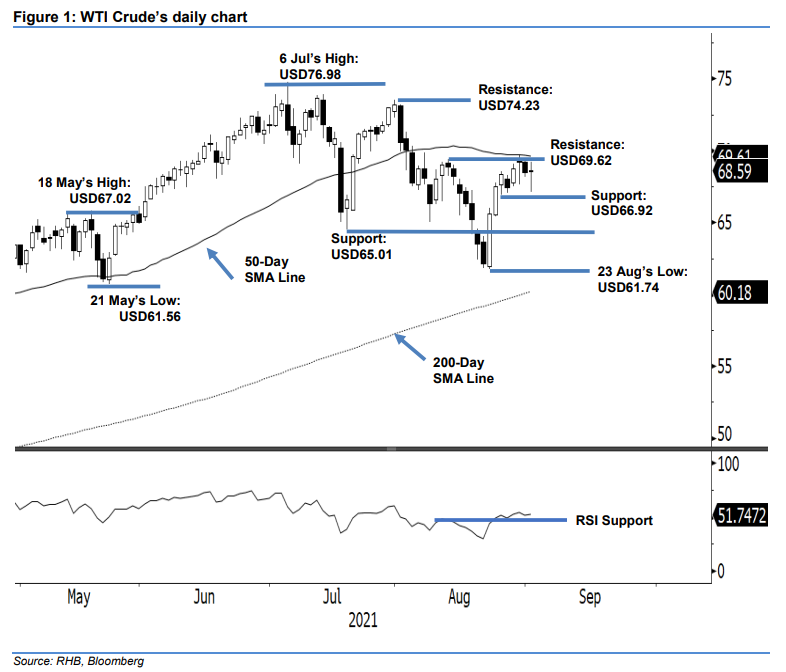

Maintain long positions. Despite attempting to hit the immediate support, the WTI Crude managed to recoup its intraday losses to close neutral a mere USD0.09 higher at USD68.59. It began with a neutral tone again at USD68.55. It later climbed higher to test the day’s peak at USD69.24. However, strong selling pressure emerged during the European trading hours, which saw the black gold fall strongly towards the USD67.12 day low. Surging buying momentum then emerged, which saw the WTI Crude bouncing off towards a mark slightly above its opening at the close. The latest lower shadow line forming near the immediate support suggests it may have found its footing near USD66.92 , hence limiting the downside risk. The bullish momentum may pick up pace again if the WTI Crude manages to breach the USD69.62 immediate resistance. The upside risk is supported by the RSI advancing above the 50% level. As long as it trades above the stop loss, we stay with our positive trading bias.

Traders should maintain the long positions initiated at the closing level of 24 Aug, or USD67.54. To mitigate risks, the stop-loss threshold is marked at USD66.92, ie 25 Aug’s low.

The nearest support level is unchanged at USD66.92 – 25 Aug’s low – and followed by USD65.00, ie 20 Jul’s low. The next two resistance levels are pegged at USD69.62 – 12 Aug’s high – and USD74.23, or 30 Jul’s high.

Source: RHB Securities Research - 2 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024