COMEX Gold: Continue Drifting Sideways

rhboskres

Publish date: Thu, 02 Sep 2021, 05:34 PM

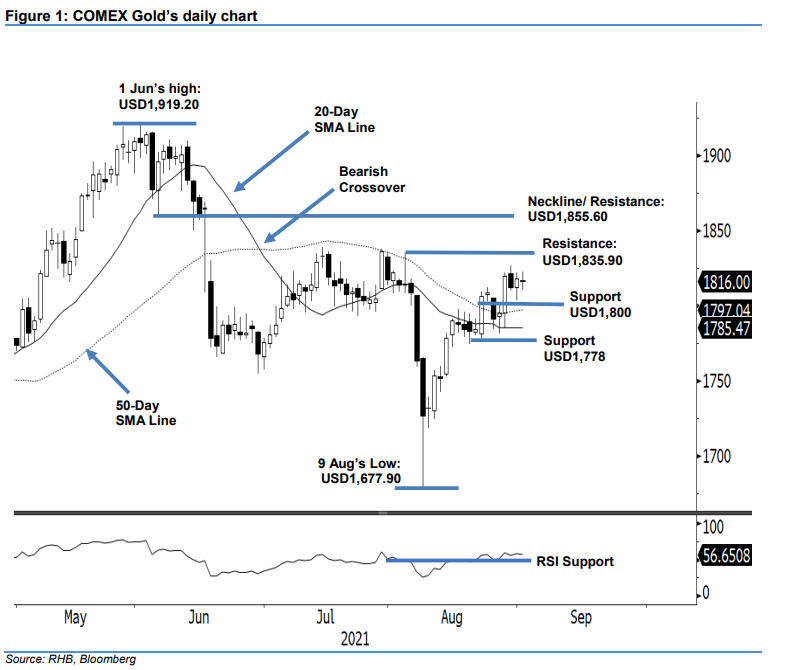

Maintain long positions. The COMEX Gold continued to consolidate sideways, declining USD2.10 marginally to settle at USD1,816. The commodity started Wednesday’s session at USD1,816.70, vacillating between USD1,822.70 and USD1,810.60 before the close. The latest session showed the bulls were taking a breather, and we might see a retracement to re-test the 50-day SMA line. We expect buying interest to emerge near the moving average, or the 1,800-pt psychological level. So far, the COMEX Gold is still posting a “higher highs with higher lows” pattern – we believe the commodity will regain its momentum after consolidations. As such, we make no change to our positive trading bias.

Traders are advised to hold on to long positions initiated at USD1,778.20, or the closing level of 13 Aug. To manage the trading risks, the stop-loss threshold is set at USD1,778.20, ie the breakeven point.

The first support remains at the USD1,800 psychological level, which is followed by USD1,778, or 23 Aug’s low. The nearest resistance is pegged at USD1,835.90 – 4 Aug’s high – and followed by the higher hurdle of USD1,855.60, ie the neckline that formed in early June.

Source: RHB Securities Research - 2 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024