FCPO - Strong Rebound From The Immediate Support

rhboskres

Publish date: Thu, 02 Sep 2021, 04:28 PM

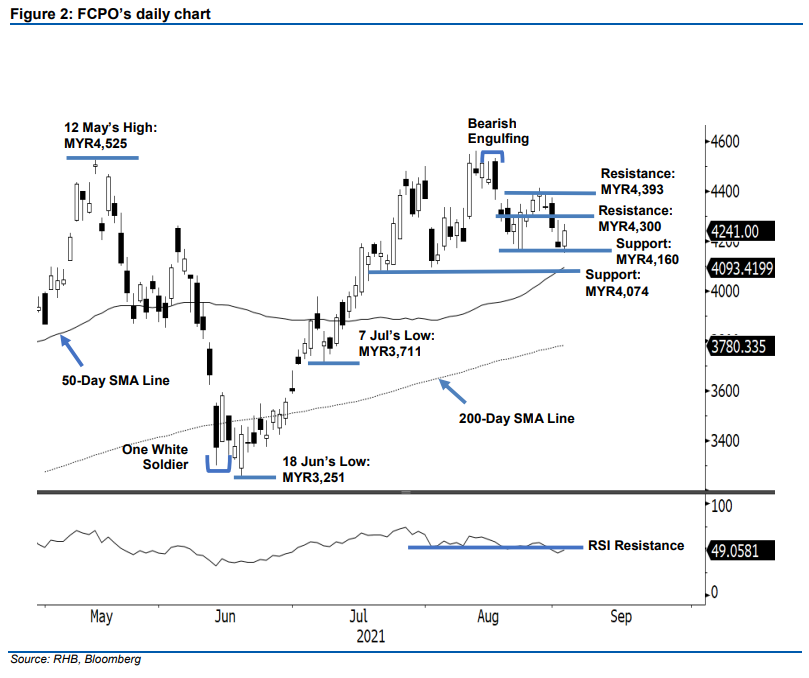

Maintain short positions. The FCPO hit strong support yesterday, rebounding MYR66.00 to settle at MYR4,242. Initially, it opened weaker at MYR4,181 and touched the MYR4,150 day low, before moving horizontally for most of the session. At the eleventh hour, it jumped to test the MYR4,266 day high before the close. The white body candlestick suggests that the commodity has found an interim low and is poised to reverse its course towards the upside. However, the MYR4,300 resistance level may poses selling pressure. Unless the bullish momentum is able to lift the FCPO over the immediate resistance, we think the commodity may consolidate sideways in the coming sessions. As such, we are keeping to our negative trading bias.

We advise traders to maintain short positions, which were initiated at MYR4,238, or the closing level of 19 Aug. To manage risks, the stop-loss is revised lower at MYR4,350.

The nearest support is unchanged at MYR4,160, or the low of 23 Aug, then MYR4,074, or the low of 22 Jul. Towards the upside, the first resistance is pegged at MYR4,300, then MYR4,393 – the high of 27 Aug.

Source: RHB Securities Research - 2 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024