COMEX Gold: Continuing to Move Horizontally

rhboskres

Publish date: Fri, 03 Sep 2021, 04:23 PM

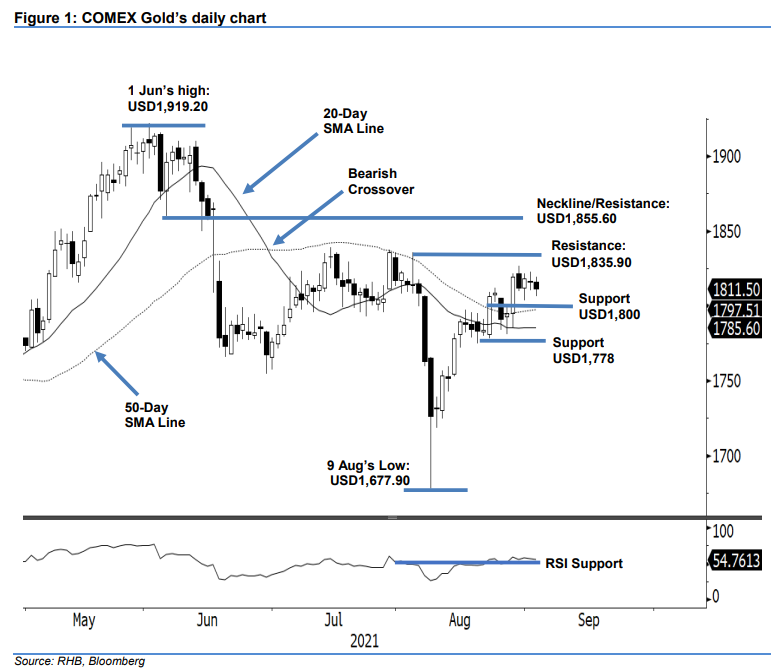

Maintain long positions. The COMEX Gold has extended its consolidations, moving sideways for the fourth consecutive session. After a neutral session, it fell USD4.50 to settle at USD1,811.50. The commodity began Thursday’s session at USD1,816.20, oscillating in a tight range between USD1,819.60 and USD1,806.50 before the close. While consolidating sideways, we observed the 20-day SMA line curving higher. If the COMEX Gold breaks above the immediate resistace, we may see the 20-day SMA line crossing above the 50-day SMA line. The bullish setup is favouring an upside movement. Conversely, breaching below the 20-day SMA line will have a negative impact on sentiment and selling pressure will increase. While waiting for a meaningful breakout, we stick to our positive trading bias.

Traders should maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To manage the downside risks, the trailing-stop mark is set at USD1,785, ie beneath the 20-day SMA line.

The first support is fixed at the USD1,800 psychological level, which is followed by USD1,778, or 23 Aug’s low. The nearest resistance is set at USD1,835.90 – 4 Aug’s high – and followed by the higher USD1,855.60 resistance, or the neckline that formed in early June.

Source: RHB Securities Research - 3 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024