WTI Crude: Breaching Above the 50-Day SMA Line

rhboskres

Publish date: Fri, 03 Sep 2021, 04:25 PM

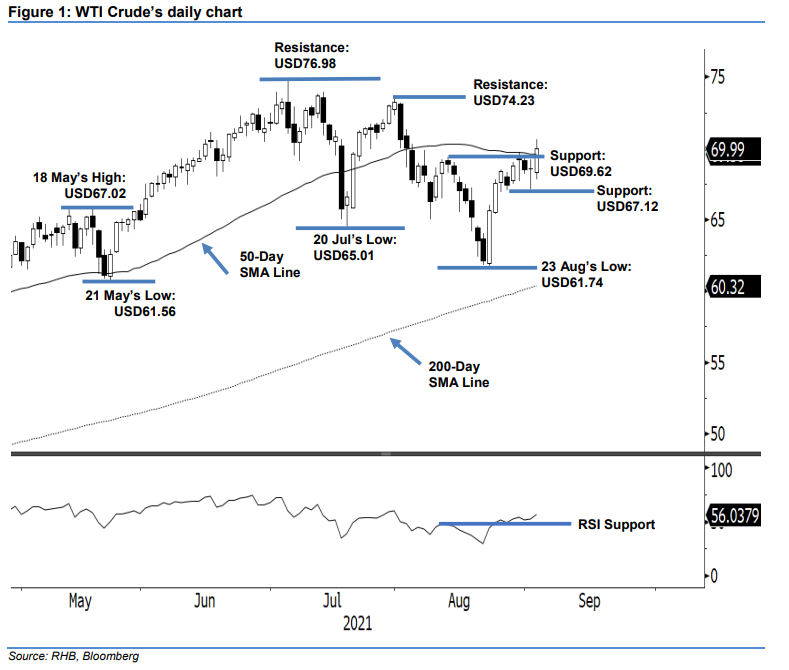

Keep long positions. The WTI Crude breached the immediate resistance yesterday, which saw it settle USD1.40 higher at USD69.99 – crossing above the 50-day SMA line. It started weaker at USD68.29 before gradually falling to the day low at USD67.84. After it found this low, buying momentum lifted the black gold northwards, which saw it peak during the US trading session at USD70.61 before retracing at its close. The most recent long white candlestick formed a fresh “higher high” pattern above the 50-day SMA line – in line with our earlier expectation that the upward movement remains in play. The renewed bullish momentum may persist above the moving average line and be supported by the strength shown in the RSI, which is trending higher – eyeing towards the 60% level. Nevertheless, we do not rule out the possibility of the WTI Crude moving sideways in the immediate sessions before climbing higher. Unless the momentum reverses and hits the stop loss, we maintain our positive trading bias.

Traders should stick to the long positions initiated at the closing level of 24 Aug, or USD67.54. To mitigate risks, the stop-loss threshold is revised higher to USD66.92, or 1 Sep’s low.

The immediate support level is revised to USD69.62, ie 12 Aug’s high, and followed by USD67.12, or 1 Sep’s low. The resistance levels are set at USD74.23 – 30 Jul’s high – and USD76.98, ie 6 Jul’s high.

Source: RHB Securities Research - 3 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024