COMEX Gold: Testing the Upside Resistance

rhboskres

Publish date: Mon, 06 Sep 2021, 10:31 AM

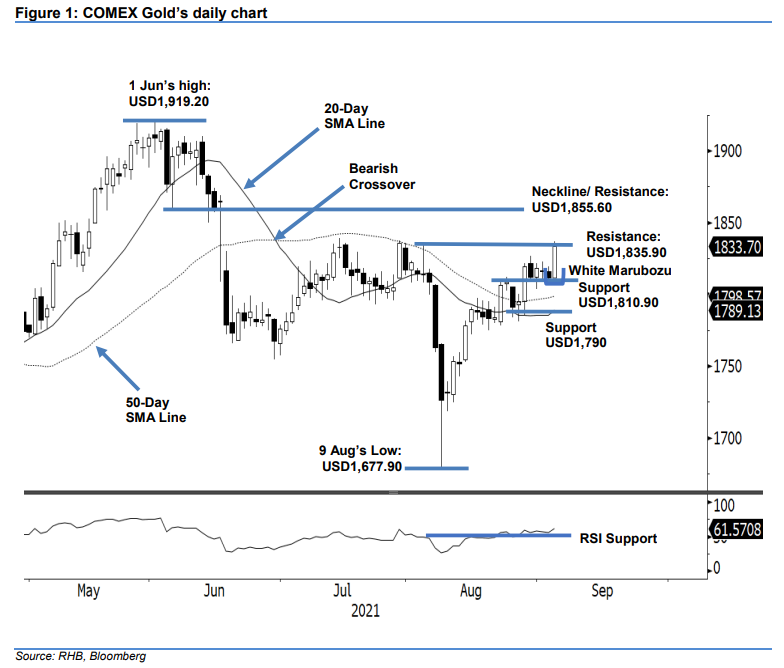

Maintain long positions. The COMEX Gold surged towards the upside resistance last Friday, jumping USD22.20 to settle at USD1,833.70. The commodity opened flat at USD1,811.50 and moved sideways for most of the session. Strong buying interest emerged before the US session began, lifting the COMEX Gold higher – it then touched the USD1,836.90 session high. The commodity finally closed at USD1,833.70, printing a White Marubozu candlestick. This long white candlestick showed that the bulls were in charge of the session and we will likely see follow-through price actions testing the USD1,835.90 immediate resistance. Breaching the resistance will open the door for more upside movements, testing the June neckline at USD1,855.60. Meanwhile, both the 50- and 20-day SMA lines will continue to support the COMEX Gold’s bullish movement. With the renewed momentum, we keep to our positive trading bias.

Traders are advised to keep the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For trading-risk management, the trailing-stop mark is raised to USD1,790, ie just below the 20-day SMA line.

The first support is marked at USD1,810.90 – 3 Sep’s low – and followed by the USD1,790 whole number. The nearest resistance is eyed at USD1,835.90, ie 4 Aug’s high, and followed by USD1,855.60 – the low of 4 Jun.

Source: RHB Securities Research - 6 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024