WTI Crude: Falling Below the 50-Day SMA Line

rhboskres

Publish date: Mon, 06 Sep 2021, 10:32 AM

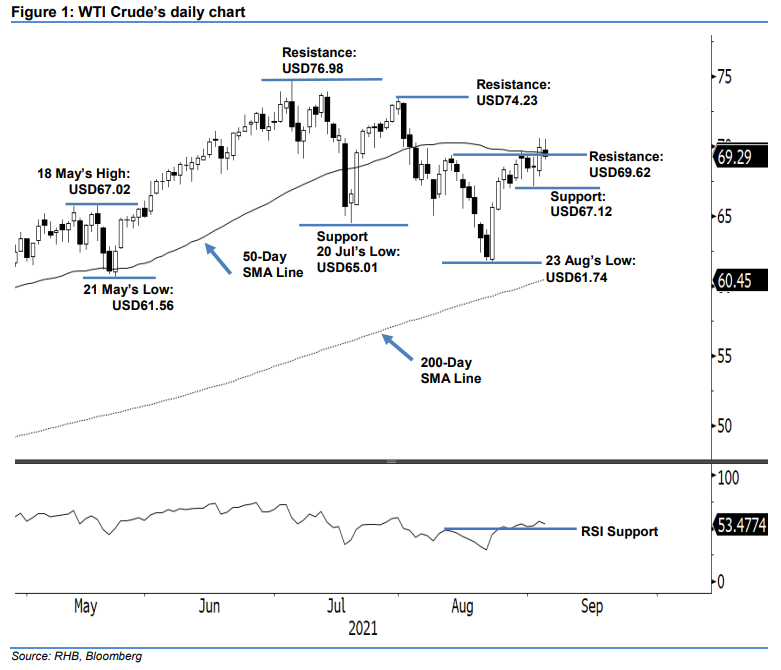

Maintain long positions. The WTI Crude bears took profit near the 50-day SMA line last Friday, which saw the commodity closing USD0.70 weaker at USD69.29 – retracing below the 50-day SMA line. It began with a negative tone at USD69.76 and gradually climbed to the day high at USD70.53 during the late European trading session. The WTI Crude then swiftly changed direction and fell strongly towards the intraday low of USD69.05 before the close. The latest black body candlestick with long upper shadow capped by the 50-day SMA line suggests that a mild pullback may continue to persist towards the USD67.12 immediate support in the coming sessions. Nevertheless, the medium-term outlook may still be biased towards the upside, as long as the “higher low” structure remains intact. This is also supported by the positive strength shown in the RSI, ie above the 50% level, despite rounding lower. With the current level trading above the stop-loss threshold, we retain our positive trading bias.

Traders should stay in the long positions initiated at the closing level of 24 Aug at USD67.54. To mitigate risks, the stop-loss threshold is marked at USD67.12, or 1 Sep’s low.

The immediate support level is revised to USD67.12 – 1 Sep’s low – and followed by USD65.01, ie 20 Jul’s low. The nearest resistance level is pegged at USD69.62 – 12 Aug’s high – and followed by USD74.23, or 30 Jul’s high.

Source: RHB Securities Research - 6 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024