FCPO: Hesitating Near The Immediate Resistance

rhboskres

Publish date: Tue, 07 Sep 2021, 10:26 AM

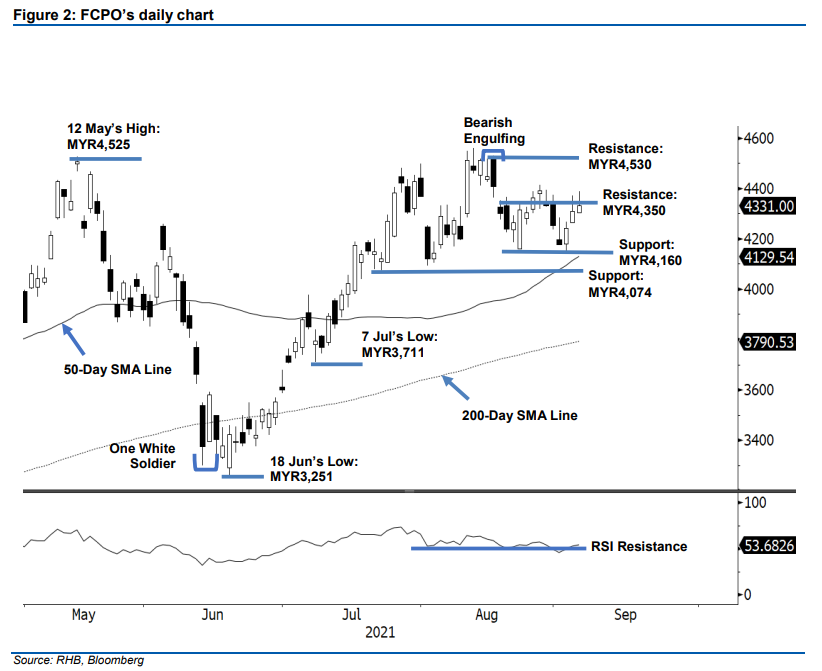

Maintain short positions. Despite closing below the immediate resistance, the FCPO managed to register its third consecutive positive session, adding MYR21 to settle at MYR4,331. On the first trading session of the week, the commodity started off at MYR4,305. Strong buying interest during the afternoon session lifted it to touch the MYR4,389 session high. However, the bulls were not convinced of the breakout, retracing below MYR4,350 to close at MYR4,331 – leaving a long upper shadow at the immediate resistance. The latest session reaffirms that MYR4,350 is a stiff resistance, and breaking above the threshold may warrant a strong upside movement. At this stage, the FCPO may consolidate towards the MYR4,160-pt support, building a stronger momentum before making a fresh attempt to cross the resistance. As long as the stop-loss stays intact, we stick to our negative trading bias.

We advise traders to keep the short positions, which were initiated at MYR4,238, or the closing level of 19 Aug. To mitigate the trading risks, the stop-loss is set at MYR4,350.

The first support is fixed at MYR4,160, or the low of 23 Aug, followed by MYR4,074, or the low of 22 Jul. Meanwhile, the nearest resistance is eyed at MYR4,350, followed by MYR4,530, the high of the Bearish Engulfing on 17 Aug.

Source: RHB Securities Research - 7 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024